- The Weekly Buzz 🐝 by Blossom

- Posts

- 🔥 Buffett Indicator Says Stock Market is 'Playing with Fire'

🔥 Buffett Indicator Says Stock Market is 'Playing with Fire'

Plus, Intel soars another 20%, Amazon falls 5% after $2.5B settlement, and more...

TOP STORY

🔥 Buffett Indicator Says Stock Market is 'Playing with Fire'

⭐️ Over the past 5 months, the US stock market has delivered one of the best rallies since the 1950s, with the S&P 500 soaring over +33% since April 8, defying essentially every warning indicator…

📉 Well, this week, the market took a slight turn for the worse, with the S&P falling for 3 straight days from Tuesday to Thursday, dropping -1.4%, its longest slump in a month - but this was offset by Monday/Friday gains for an overall fairly flat week. Over the week:

The S&P 500 dipped -0.16%

The Nasdaq 100 dipped -0.34%

The Canadian TSX index dipped -0.10%

😰 Still, whenever there’s a dip, it always leads to questions (and headlines) on how much longer the good times can last, and despite the gains, experts say there are many reasons for investors to be worried.

🤿 So before we dive into the other headlines of the week, let’s talk about the market warning signs and what you should do about them.

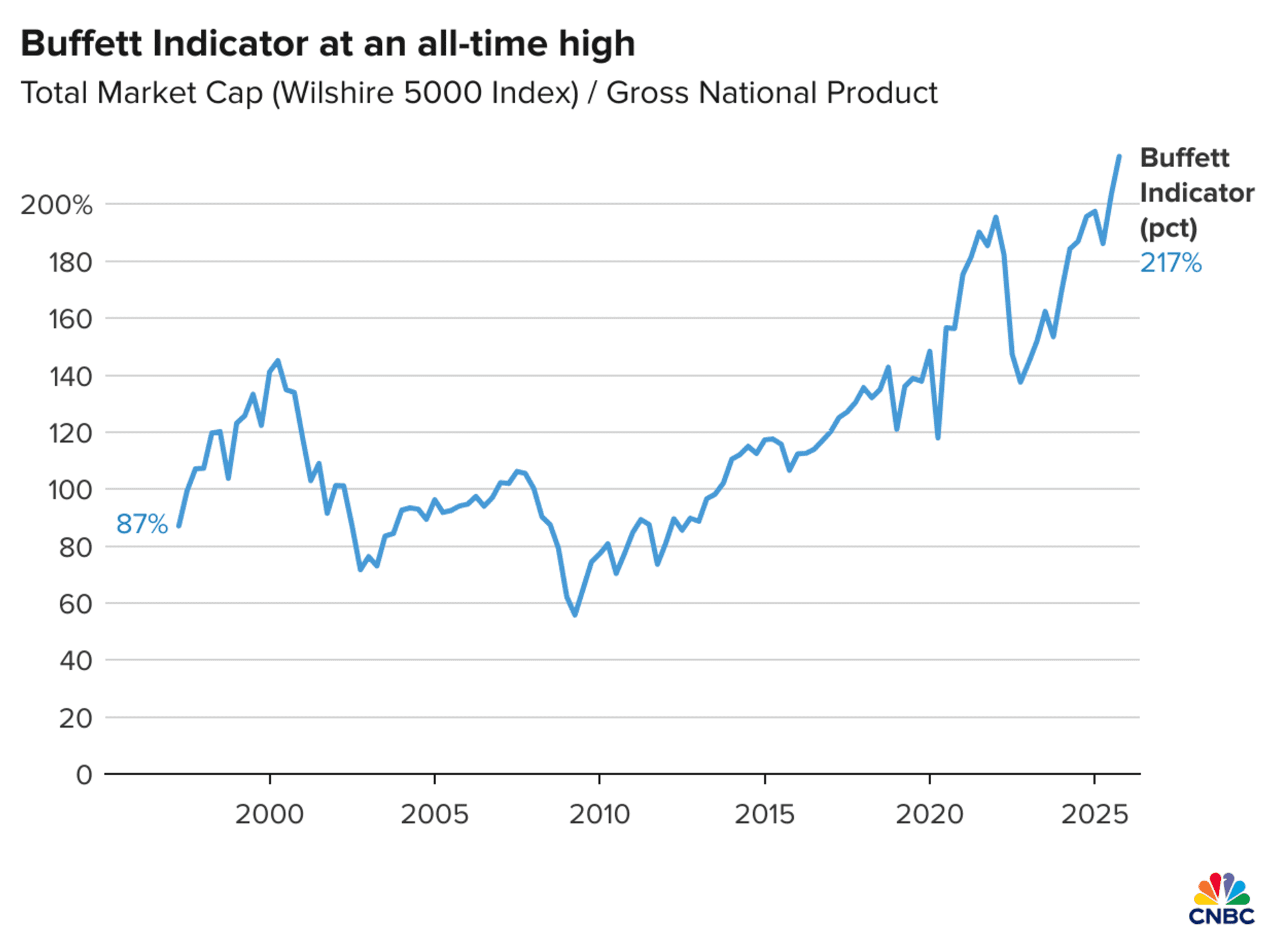

🔥 ‘Buffett Indicator’ Hits An All-Time High, Reaching Levels Buffett Once Said Were ‘Playing with Fire’

⚠️ The first warning sign to talk about is the ‘Buffett Indicator’, which has been making headlines for passing a level of 200%, with Buffett once saying:

“If the ratio approaches 200% - as it did in 1999 and a part of 2000 (the dot-com crash) - you’re playing with fire”

📊 The indicator measures the ratio of the US stock market to the US economy, essentially acting as a sort of guide on how expensive/inexpensive stocks are, and while Buffett hasn’t referenced it lately, he once called it the ‘single best measure of where valuations stand at any given moment’.

🚨 While some say the Buffett Indicator is no longer relevant, other valuation metrics show similar warning signals:

The Shiller P/E ratio of the S&P is at 39.9x, the 3rd highest it’s been in 150 years

The S&P 500’s price-to-sales ratio is at 3.33x, another all-time high, and above even the 3.21x reached during the Covid-boom

😰 All these signals point to the fact that the market may be overvalued, and therefore long overdue for a correction…

🫣 Trump Adds More Uncertainty With More Tariffs and H1-B Visa Chaos

😬 Another worry for investors is that, after a period of somewhat relative calm, Trump is back to injecting more uncertainty into the market, with new tariffs on things like brand-name drugs and heavy trucks.

✍️ Even more significant is Trump’s new executive order on H-1B visas, which came a little out of nowhere and is already impacting some of the biggest tech companies in the US.

💰 Essentially, the rule states that employers must pay a $100,000 fee for every foreign worker under the H-1B visa. And while this impacts only a small portion of the US workforce overall, the new rule has ruffled feathers among big tech, as Amazon, Microsoft, Google, and Meta consistently rank among the top H1-B sponsors, relying on the visa for top tech talent.

❌ The biggest worry is that the policy will hurt the 'big tech talent pipeline’, and make the US less attractive for tech:

“As the US slams the door with a $100,000 paywall, the U.K. becomes incredibly attractive”

👀 All Eyes On Earnings

🗓️ The next big event on the horizon is earnings season, with JP Morgan kicking off earnings on Oct 14… and according to analysts, expectations are high.

🎯 According to Citi Research, aggressive corporate earnings growth is already priced into stocks, with the market expecting 8% earnings growth, a forward growth expectation only seen twice in the past 30 years, both times right before selloffs in 1999 and in 2021.

🤔 Ok… So What’s the Point?

😬 All right so there’s warning signs, does that mean you should sell everything?

👎 Well no, trying to time the market has historically proven to be a bad strategy, and even with all the warning signs, history shows that rallies like the one we’re in are difficult to derail.

📈 Since 1950, the S&P 500 has advanced by roughly +5.5% on average in the final months of the year when it has notched at least 20 records by late August, as it did this year.

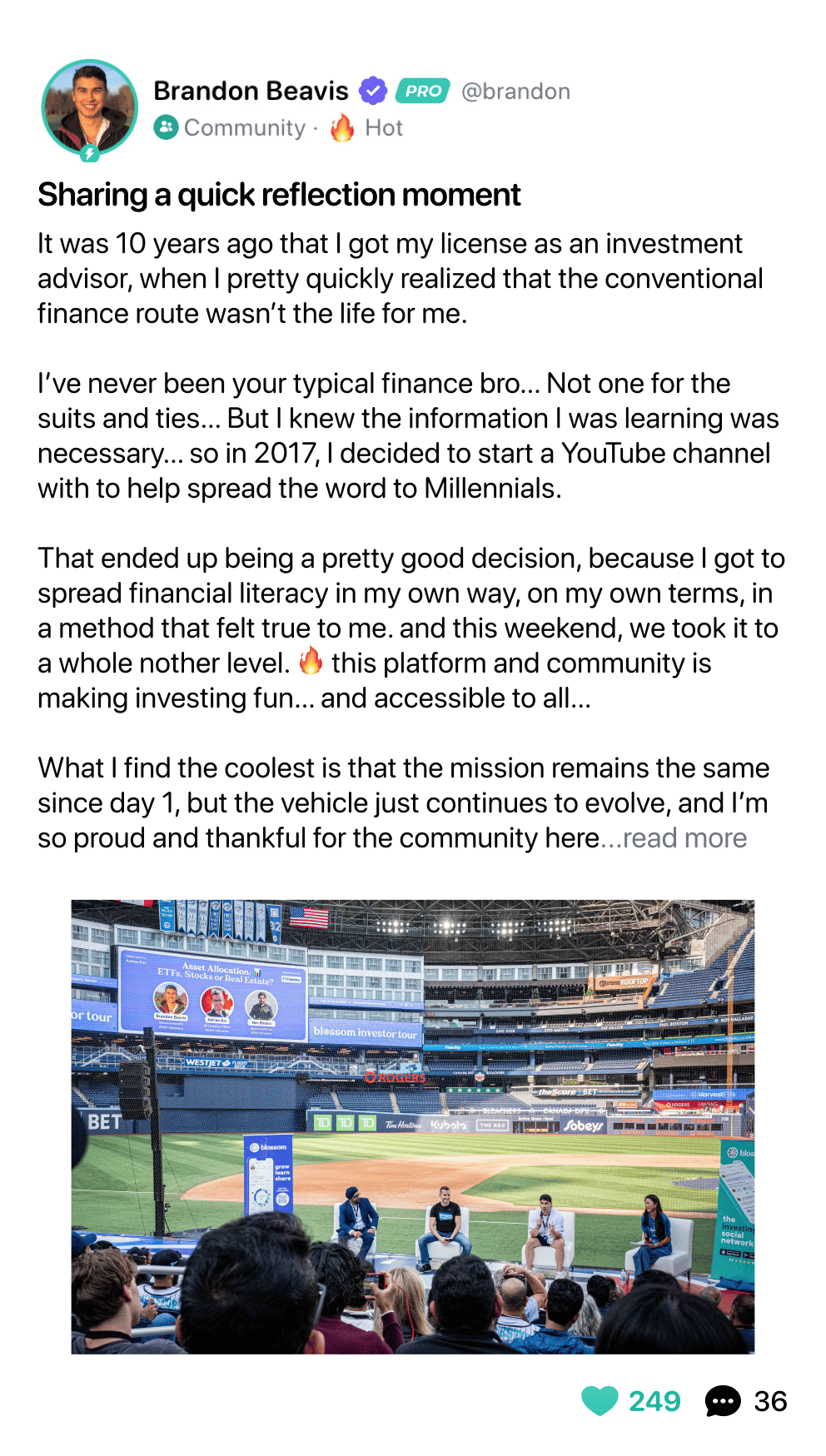

But to paraphrase Marc Beavis from the Blossom Toronto Conference:

“It’s not a matter of if there will be a crash, but when. If you’re investing for the long-term, you will experience a crash, or many crashes in your lifetime, so make sure you, and your portfolio, are ready for it.”

📄 So if I may, for the first time in Weekly Buzz history, I’m going to assign 5 mins of homework… my ask for you all is to take a hard look at your portfolio and ask:

Have you taken on more risk than you can stomach in the event of a crash?

Are you reacting emotionally and following the herd, picking up riskier and riskier positions without a clear thesis?

How would you feel if your portfolio fell -20-30% tomorrow? Would you be ok?

💡 And for more of my thoughts on this, make sure you read my post last month on a similar topic when the S&P PE hit 30x.

⭐️ I know sometimes I might come across like a broken record, as I’ve been making a similar point over and over for the past year and a bit, but with so many new investors and beginners joining Blossom who haven’t experienced their first crash, I think it’s so important for us to continuely check in with ourselves (and eachother) to make sure we’re not getting swept up in the wave of excitement thats surrounding the markets these days and taking on more risk than we’re truly comfortable with.

🔍 All right, before we break down some of the other big headlines this week, a quick word from this week’s sponsor, Fidelity Investments Canada!

SPONSORED BY FIDELITY INVESTMENTS CANADA

🤝 Active Strategies from Active Portfolio Managers

😎 Why choose between flexibility and expertise when you can have both?

💰 Fidelity Active ETFs can act as a shortcut to savvy investing. You get the versatility of ETFs and the brainpower of Fidelity’s portfolio managers wrapped into one solution. That means you’re not just riding the market, you’ve got a team helping navigate it.

📈 Whether you’re looking for capital growth or income, or want a balanced mix, there’s a Fidelity Active ETF for that. From equity and fixed income to multi-asset and liquid alternative strategies, Fidelity has many options for you to consider.

Check out the library of Fidelity Active ETFs and get active today.

*See Fidelity Investments Canada Disclaimer at the end of the newsletter

IN OTHER NEWS

🗞️ Top Headlines This Week

👀 Outside of the macro-indicators, here are some of the other big headlines that caught my eye this week…

🍎 Apple Up +3% After Launching ChatGPT-Like App to Test the Revamped Siri and As Rumors Swirl Over Intel Investment

Apple ($AAPL) has built a ChatGPT-style iPhone app (internally named “Veritas”) to test next-gen Siri features, including contextual chat, email/music search, and other in-app actions.

The app is for internal use only and not intended for public release, serving as a sandbox for Apple’s AI team to iterate quickly.

Intel has also reportedly approached Apple about a possible investment amid its turnaround efforts, with the potential to reshape Apple’s chip supply (despite Apple having fully transitioned off Intel for Macs)

As a result, Apple’s stock jumped +3% this week, reflecting investor optimism around both the AI developments and chip strategy diversification.

🚀 Intel Jumps Another +20% On Speculation of Apple Investment

The rumours of Apple’s investment in Intel also fueled a sharp rally in Intel ($INTC), with the stock rising 20% this week on top of the +22% we reported on last week after the $5B investment from Nvidia.

Analysts caution that talks are still in early stages and no deal has been confirmed, so the jump could reverse if the investment doesn’t materialize.

The surge comes amid a broader revival narrative originally sparked when the US government announced it would buy 10% of Intel.

📉 Amazon Down -5% After $2.5B FTC Settlement Over Prime

Amazon ($AMZN) fell -5% after agreeing to a $2.5 billion settlement to resolve FTC claims it misled customers into joining Prime and made cancellation difficult.

Of that amount, $1 billion is a fine and $1.5 billion is earmarked for refunds to ~35 million affected subscribers.

Eligible subscribers (signed up between June 2019 and June 2025) will receive ~$51 automatically; others can file claims.

Amazon didn’t admit wrongdoing, but must simplify cancellation, increase transparency, and submit to compliance oversight.

😰 Constellation Software Crashes 17% After Founder and CEO Steps Down

Constellation Software ($CSU) founder and president, Mark Leonard, unexpectedly resigned for health reasons this week, triggering a -17% drop in the stock.

Analysts cut ratings and price targets, citing concerns about replacing Leonard’s unique vision and leadership influence.

Supporters point to Constellation’s decentralized structure and long runway in niche vertical-software deals as cushions during the transition.

✨ Oracle Drops -8%, But is Still Up 101% in the Past 6 Months Amid CEO Exit, Bond Issuance, and TikTok Purchase

Oracle ($ORCL) shares fell ~8% today, likely triggered by concerns over leadership change as CEO Safra Catz steps down after 11 years at the helm.

Despite this week’s drop, over the past six months, the stock has surged ~101% as investors embraced Safra’s cloud growth and strategic bets.

One such bet is Oracle’s lead role in a consortium to buy ~50% of TikTok, with Trump signing an executive order this week declaring his plan to sell TikTok’s US operations at a deal valued at $14B

Amid these developments, Oracle has reportedly issued bonds to raise capital, heightening questions about its balance sheet stress and cost of debt

PRESENTED BY CIBC ETFS

🔎 Spotlight: CIBC Asset Management’s New Covered Call ETF Suite

💵 Looking to enhance your portfolio’s cash flow without giving up your equity exposure? This week’s spotlight features the newly launched covered call ETFs from CIBC Asset Management, designed to meet the needs of investors seeking both income and growth. Each ETF brings a unique focus:

🏦 CCCB: CIBC Canadian Banks Covered Call ETF, offering exposure to Canada’s leading banks with an added covered call overlay for enhanced monthly income potential.

🤑 CCDC: CIBC Canadian High Dividend Covered Call ETF, focusing on high-quality Canadian dividend stocks with the goal of providing regular monthly cash flow.

💰 CUDC / CUDC.F: CIBC US High Dividend Covered Call ETF, delivering access to top US dividend payers plus the benefits of a covered call strategy with regular monthly cash flow.

📈 All three ETFs are actively managed by CIBC Asset Management’s experienced team and are built to deliver regular distributions, growth potential, and efficient portfolio integration.

🎯 Investors can review each fund’s objectives, holdings, and unique features to see how they align with their financial goals.

Take the next step:

*See CIBC ETFs Disclaimer at the end of the newsletter

UPCOMING EVENT

🎙️ Harvest Ask Me Anything On Blossom

Harvest ETFs like $HHIS have been a hot topic on Blossom, with many questions swirling around Harvest’s unique covered call strategy.

Well now is your chance to chat directly with Harvest’s Chief Investment Officer Paul MacDonald, on our first ever AMA hosted directly on Blossom!

On Tuesday, Sep 30, Paul will be online to answer all your questions about Harvest’s strategy and funds - feel free to bookmark the post and submit your questions in advance here!

Fidelity Investments Canada Disclaimer

Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Please read the mutual fund’s or ETF’s prospectus, which contains detailed investment information, before investing. Mutual funds and ETFs are not guaranteed. Their values change frequently, and investors may experience a gain or a loss. Past performance may not be repeated.

© 2025 Fidelity Investments Canada ULC. All rights reserved. Fidelity Investments is a registered trademark of Fidelity Investments Canada ULC

CIBC ETFs Disclaimer

The views expressed in this material are the views of CIBC Asset Management Inc., as of September 2025 unless otherwise indicated, and are subject to change at any time. This material is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this material should consult with their advisor. The material and/or its contents may not be reproduced without the express written consent of CIBC Asset Management Inc. CIBC ETFs are managed by CIBC Asset Management Inc., a subsidiary of Canadian Imperial Bank of Commerce. Commissions, management fees and expenses all may be associated with investments in exchange traded funds (ETFs). Read the CIBC ETFs prospectus or ETF Facts document before investing. To get a copy, ask your advisor, call 1-888-888-3863 or visit CIBC.com/etfs. ETFs aren’t guaranteed, their values change frequently and past performance may not be repeated.