- The Weekly Buzz 🐝 by Blossom

- Posts

- 🔥 Buffett Indicator Says Stock Market is 'Playing with Fire' (US)

🔥 Buffett Indicator Says Stock Market is 'Playing with Fire' (US)

Plus, Intel soars another 20%, Amazon falls 5% after $2.5B settlement, and more...

TOP STORY

🔥 Buffett Indicator Says Stock Market is 'Playing with Fire'

⭐️ Over the past 5 months, the US stock market has delivered one of the best rallies since the 1950s, with the S&P 500 soaring over +33% since April 8, defying essentially every warning indicator…

📉 Well, this week, the market took a slight turn for the worse, with the S&P falling for 3 straight days from Tuesday to Thursday, dropping -1.4%, its longest slump in a month - but this was offset by Monday/Friday gains for an overall fairly flat week. Over the week:

The S&P 500 dipped -0.16%

The Nasdaq 100 dipped -0.34%

The Canadian TSX index dipped -0.10%

😰 Still, whenever there’s a dip, it always leads to questions (and headlines) on how much longer the good times can last, and despite the gains, experts say there are many reasons for investors to be worried.

🤿 So before we dive into the other headlines of the week, let’s talk about the market warning signs and what you should do about them.

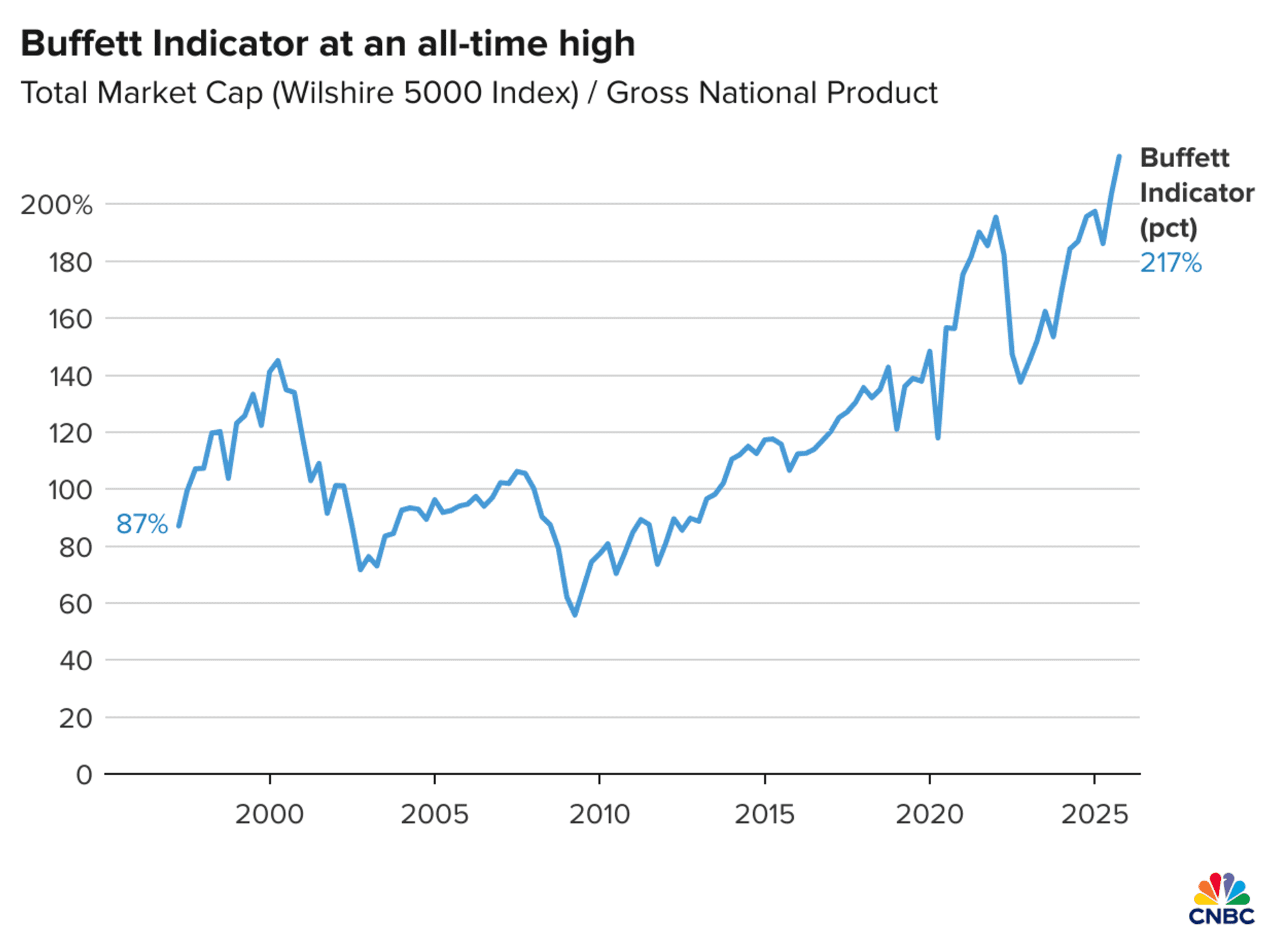

🔥 ‘Buffett Indicator’ Hits An All-Time High, Reaching Levels Buffett Once Said Were ‘Playing with Fire’

⚠️ The first warning sign to talk about is the ‘Buffett Indicator’, which has been making headlines for passing a level of 200%, with Buffett once saying:

“If the ratio approaches 200% - as it did in 1999 and a part of 2000 (the dot-com crash) - you’re playing with fire”

📊 The indicator measures the ratio of the US stock market to the US economy, essentially acting as a sort of guide on how expensive/inexpensive stocks are, and while Buffett hasn’t referenced it lately, he once called it the ‘single best measure of where valuations stand at any given moment’.

🚨 While some say the Buffett Indicator is no longer relevant, other valuation metrics show similar warning signals:

The Shiller P/E ratio of the S&P is at 39.9x, the 3rd highest it’s been in 150 years

The S&P 500’s price-to-sales ratio is at 3.33x, another all-time high, and above even the 3.21x reached during the Covid-boom

😰 All these signals point to the fact that the market may be overvalued, and therefore long overdue for a correction…

🫣 Trump Adds More Uncertainty With More Tariffs and H1-B Visa Chaos

😬 Another worry for investors is that, after a period of somewhat relative calm, Trump is back to injecting more uncertainty into the market, with new tariffs on things like brand-name drugs and heavy trucks.

✍️ Even more significant is Trump’s new executive order on H-1B visas, which came a little out of nowhere and is already impacting some of the biggest tech companies in the US.

💰 Essentially, the rule states that employers must pay a $100,000 fee for every foreign worker under the H-1B visa. And while this impacts only a small portion of the US workforce overall, the new rule has ruffled feathers among big tech, as Amazon, Microsoft, Google, and Meta consistently rank among the top H1-B sponsors, relying on the visa for top tech talent.

❌ The biggest worry is that the policy will hurt the 'big tech talent pipeline’, and make the US less attractive for tech:

“As the US slams the door with a $100,000 paywall, the U.K. becomes incredibly attractive”

👀 All Eyes On Earnings

🗓️ The next big event on the horizon is earnings season, with JP Morgan kicking off earnings on Oct 14… and according to analysts, expectations are high.

🎯 According to Citi Research, aggressive corporate earnings growth is already priced into stocks, with the market expecting 8% earnings growth, a forward growth expectation only seen twice in the past 30 years, both times right before selloffs in 1999 and in 2021.

🤔 Ok… So What’s the Point?

😬 All right so there’s warning signs, does that mean you should sell everything?

👎 Well no, trying to time the market has historically proven to be a bad strategy, and even with all the warning signs, history shows that rallies like the one we’re in are difficult to derail.

📈 Since 1950, the S&P 500 has advanced by roughly +5.5% on average in the final months of the year when it has notched at least 20 records by late August, as it did this year.

But to paraphrase Marc Beavis from the Blossom Toronto Conference:

“It’s not a matter of if there will be a crash, but when. If you’re investing for the long-term, you will experience a crash, or many crashes in your lifetime, so make sure you, and your portfolio, are ready for it.”

📄 So if I may, for the first time in Weekly Buzz history, I’m going to assign 5 mins of homework… my ask for you all is to take a hard look at your portfolio and ask:

Have you taken on more risk than you can stomach in the event of a crash?

Are you reacting emotionally and following the herd, picking up riskier and riskier positions without a clear thesis?

How would you feel if your portfolio fell -20-30% tomorrow? Would you be ok?

💡 And for more of my thoughts on this, make sure you read my post last month on a similar topic when the S&P PE hit 30x.

⭐️ I know sometimes I might come across like a broken record, as I’ve been making a similar point over and over for the past year and a bit, but with so many new investors and beginners joining Blossom who haven’t experienced their first crash, I think it’s so important for us to continuely check in with ourselves (and eachother) to make sure we’re not getting swept up in the wave of excitement thats surrounding the markets these days and taking on more risk than we’re truly comfortable with.

🔍 All right, before we break down some of the other big headlines this week, a final word about our upcoming events in Chicago and LA!

UPCOMING EVENTS

🤝 Last Chance for Tickets to Chicago & LA (New York Now Sold Out!)

😎 We’re 1 week away from our first US event in New York, and I’m excited (and sad to say) that it’s already sold out!

🥳 But for our Chicago/LA friends, you’re in luck as we still have a few tickets left!

🤑 Come join us for an evening all about investing & personal finance, with food & drinks, meeting fellow investors, and panels featuring some of your favourite investing creators.

For Chicago, we’ll have panels covering:

🔑 Keys to Success: Becoming a Better Investor ft Ari Gutman, Dollars With Drew, Joseph Hogue, and Justin (etf.investments)

💸 Dividends & High Income Strategy ft. Marcos Milla, PPCIan, Dapper Dividends, Joyee Yang

For LA, we’ll have panels covering:

💰 Investing for Beginners: The Road to $100,000 ft. MeghanMakesMoney, Lillian Zhang, BD Investing, and Davy

🎯 Finding Your Investing Strategy: Trading, Income, or ETFs ft. Ari Gutman, Marcos Milla, and The Humbled Trader

IN OTHER NEWS

🗞️ Top Headlines This Week

👀 Outside of the macro-indicators, here are some of the other big headlines that caught my eye this week…

🍎 Apple Up +3% After Launching ChatGPT-Like App to Test the Revamped Siri and As Rumors Swirl Over Intel Investment

Apple ($AAPL) has built a ChatGPT-style iPhone app (internally named “Veritas”) to test next-gen Siri features, including contextual chat, email/music search, and other in-app actions.

The app is for internal use only and not intended for public release, serving as a sandbox for Apple’s AI team to iterate quickly.

Intel has also reportedly approached Apple about a possible investment amid its turnaround efforts, with the potential to reshape Apple’s chip supply (despite Apple having fully transitioned off Intel for Macs)

As a result, Apple’s stock jumped +3% this week, reflecting investor optimism around both the AI developments and chip strategy diversification.

🚀 Intel Jumps Another +20% On Speculation of Apple Investment

The rumours of Apple’s investment in Intel also fueled a sharp rally in Intel ($INTC), with the stock rising 20% this week on top of the +22% we reported on last week after the $5B investment from Nvidia.

Analysts caution that talks are still in early stages and no deal has been confirmed, so the jump could reverse if the investment doesn’t materialize.

The surge comes amid a broader revival narrative originally sparked when the US government announced it would buy 10% of Intel.

📉 Amazon Down -5% After $2.5B FTC Settlement Over Prime

Amazon ($AMZN) fell -5% after agreeing to a $2.5 billion settlement to resolve FTC claims it misled customers into joining Prime and made cancellation difficult.

Of that amount, $1 billion is a fine and $1.5 billion is earmarked for refunds to ~35 million affected subscribers.

Eligible subscribers (signed up between June 2019 and June 2025) will receive ~$51 automatically; others can file claims.

Amazon didn’t admit wrongdoing, but must simplify cancellation, increase transparency, and submit to compliance oversight.

😰 Constellation Software Crashes 17% After Founder and CEO Steps Down

Constellation Software ($CSU) founder and president, Mark Leonard, unexpectedly resigned for health reasons this week, triggering a -17% drop in the stock.

Analysts cut ratings and price targets, citing concerns about replacing Leonard’s unique vision and leadership influence.

Supporters point to Constellation’s decentralized structure and long runway in niche vertical-software deals as cushions during the transition.

✨ Oracle Drops -8%, But is Still Up 101% in the Past 6 Months Amid CEO Exit, Bond Issuance, and TikTok Purchase

Oracle ($ORCL) shares fell ~8% today, likely triggered by concerns over leadership change as CEO Safra Catz steps down after 11 years at the helm.

Despite this week’s drop, over the past six months, the stock has surged ~101% as investors embraced Safra’s cloud growth and strategic bets.

One such bet is Oracle’s lead role in a consortium to buy ~50% of TikTok, with Trump signing an executive order this week declaring his plan to sell TikTok’s US operations at a deal valued at $14B

Amid these developments, Oracle has reportedly issued bonds to raise capital, heightening questions about its balance sheet stress and cost of debt

PARTNERSHIP WITH PUBLIC

🎁 Sign up for Public and Get Free Blossom PRO Access!

🔥 Did you know that through our partnership with Public, if you sign up for a Public account and connect it to Blossom, you unlock Blossom Pro for free?

💸 On top of that Public also has some of the best yields in the market, with a high-yield cash account of 4.1%, a Bond Account of 5.6%, and a 1% IRA match!

⭐️ The app is also jam-packed with useful features like ‘Key Moments’ which share AI-generated summaries on the reasons behind every major stock price movement

😎 If you haven’t signed up already, definitely check them out!