- The Weekly Buzz 🐝 by Blossom

- Posts

- 🚀 Coinbase, Circle, and Ethereum Soar After Congress Passes Pro-Crypto Bills

🚀 Coinbase, Circle, and Ethereum Soar After Congress Passes Pro-Crypto Bills

Plus, Are Utilities the Next AI-Play? Nvidia Scores a Big Win, and more...

TOP STORY

🚀 Coinbase, Circle, and Ethereum Soar After Congress Passes Pro-Crypto Bills

🏆 While the S&P 500 and the Nasdaq-100 had decent gains this week (up +0.7% and +1.3%), the real winner was crypto…

🪙 After 3 important crypto bills were passed in the US Congress, cryptocurrencies and crypto stocks were sent soaring - this week:

Coinbase ($COIN) is up +7%

Circle ($CRCL) is up +18%

Ethereum ($ETH) is up +26%

Bitcoin ($BTC) is up +1.6%

🏆 This Monday, Bitcoin also set a new record, surpassing $120,000 USD, and became the 5th most valuable asset in the world, passing Amazon.

💡 So before we dive into some of the other interesting stories this week (like whether Utilities are the next AI play), let’s take a look at why crypto is soaring…

🎥 P.S. If you prefer video breakdowns, I’ve been posting more market news recaps on Instagram - check out my breakdown of the crypto bills here!

🗳️ Congress Passes 3 Landmark Pro-Crypto Bills

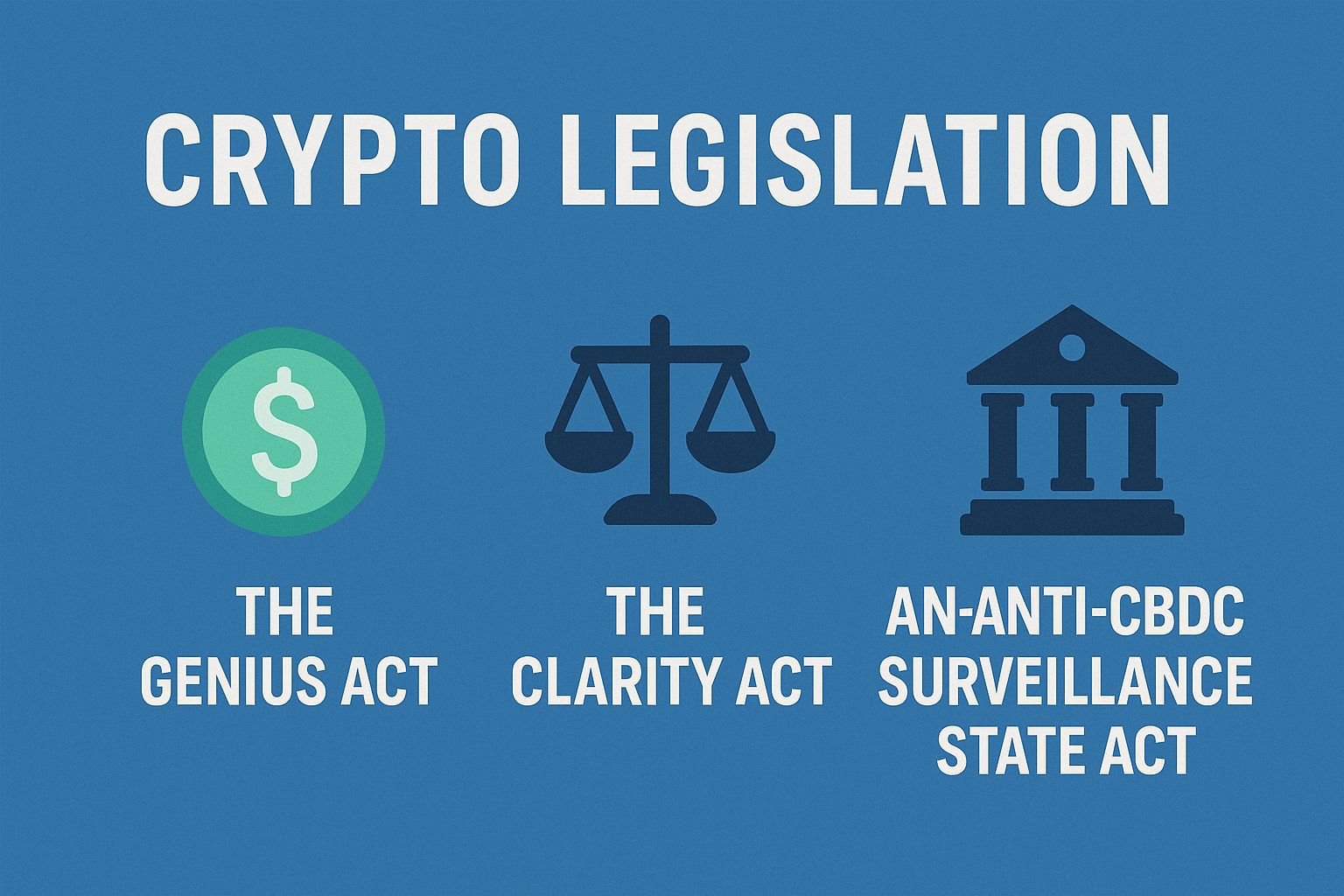

⭐️ In what’s being called a ‘watershed moment’ for crypto, 3 massive pieces of crypto-friendly legislation were passed this week:

The GENIUS Act: A bill that acts as a regulatory framework for stablecoins (a cryptocurrency pegged to the US dollar), legitimizing the tokens and integrating them into the US economy.

The CLARITY Act: A crypto market structure bill that “aims to settle the long-standing confusion around how crypto is classified in the US financial system”, splitting regulatory oversight between the SEC and the Commodity Futures Trading Commission depending on whether the coin is considered a security or a commodity. Specifically, blockchains ‘without individual control’ and ‘with transparent and public operations’ will be treated as commodities.

The Anti-CBDC Surveillance State Act: which blocks the Federal Reserve from launching a central bank digital currency.

🤔 Why Does It Matter?

😰 For years, the threat of lawsuits and mixed messages from US regulators has put fear in the hearts of crypto-investors. But now, with the president and government embracing the crypto industry, the industry is flying high.

✅ These bills are set to drive significantly more structure and credibility to the sector, paving the way for more institutional investments. In the words of Coinbase’s Chief Policy Officer:

“These bills reduce regulatory ambiguity, and that’s a strong tailwind for crypto assets and for publicly traded companies with exposure to the space. If you’re an investor…that reduces headline risk [and] opens the door for more institutional capital.”

🥳 The two companies celebrating the most this week were Coinbase and Circle who will benefit substantially from both the GENIUS and the CLARITY Act (as we covered in detail a few weeks back).

📈 Another stock mentioned in a few articles was Galaxy Digital ($GLXY), which jumped +30% this week on the news.

👀 What’s Next

✍️ The GENIUS Act was passed in the Senate last month, and so was signed into law by the President on Friday.

🧑⚖️ The CLARITY Act and the Anti-CBDC Act still need to pass the Senate which, as many are quick to call out, is easier said than done and may come with substaintial changes to the bills before they’re signed into law:

“Passing [The CLARITY Act] is symbolically important, but what will matter is the language that the Senate can pass”

⚠️ One of the challenges is Trump’s own crypto ventures, which have led Senate Democrats to raise concerns that the bills don’t prohibit Trump or other government officials from profiting off of coins.

⏰ According to Barrons, it could “take months to write a bill that gets the 7 Democratic votes needed to surmount a filibuster,” but even though there are still challenges ahead, this week still marked a huge step forward for crypto.

⚡️ Ok, enough about crypto, before we turn to whether Utilities are the next AI-play, a quick word from today’s sponsor, Harvest ETFs!

PRESENTED BY HARVEST ETFS

🤑 Harvest Bitcoin ETFs | Tap into the Bitcoin Boom

🖐️ Bitcoin is now one of the 5-largest assets on the planet based on market cap. Trillions are flowing into the crypto space from retail and institutional investors. The crypto future is here.

New Harvest Bitcoin ETFs let you tap into the Bitcoin boom with monthly distributions!

Top companies that derive value by providing services around Bitcoin

Access the movement of the price of Bitcoin by investing in one or more Bitcoin ETFs.

🔍 Why HBTE & HBIX?

Bitcoin and crypto are known for volatility. Harvest ETFs’ option writing strategy capitalizes on this – Volatility provides an opportunity to generate high option premiums.

With bitcoin’s price movement and market uncertainty, income strategies like HBIX and HBTE offer 25% levered exposure to Bitcoin and/or its ecosystem for monthly income and growth potential.

Learn more about how to get Bitcoin exposure with monthly income.

*Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. This content is meant to provide general information for educational purposes. Both ETFs are classified as alternative exchange traded funds: they use a 25% leverage based on their net asset values. Leverage amplifies both the upside and downside returns potential and therefore introduces higher return volatility.

TO CONSIDER

⚡️ Are Utilities the Next AI Play?

⚡️ As large Wall Street investment firms move fast to acquire utilities companies, many are starting to look to Utilities to profit off the AI boom.

BlackRock is looking to buy Minnesota Power

Blackstone announced an agreement to buy TXNM Energy

🤖 This is because the rising adoption of AI is leading to a rising demand for electricity at data centres.

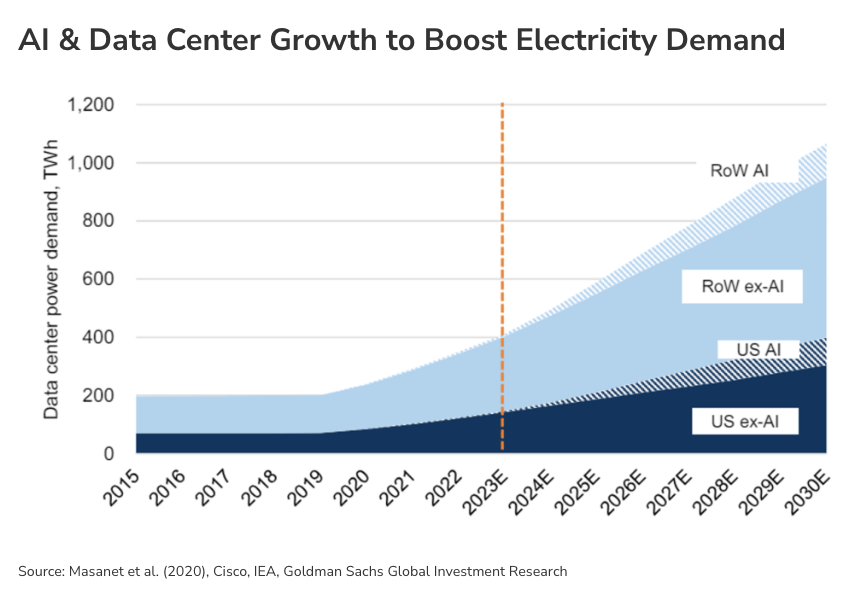

💡 In one study by Goldman Sachs, Goldman predicted that data centres will consume 3-4% of the world’s power by the end of the decade, as AI queries are 6-10 times more power-intensive than Google searches.

“This kind of spike in power demand hasn’t been seen in the US since the early years of the century”

🚩 Despite private equity interest, the PE firms will face regulatory challenges as state judges and consumer advocates argue that the firms will drive up rates for everyday Americans.

👷♀️ But just this week, Google, Meta, Blackstone, and CoreWeave announced plans to spend hundreds of billions of dollars to construct new AI data centers, so these power needs are not likely to go away any time soon.

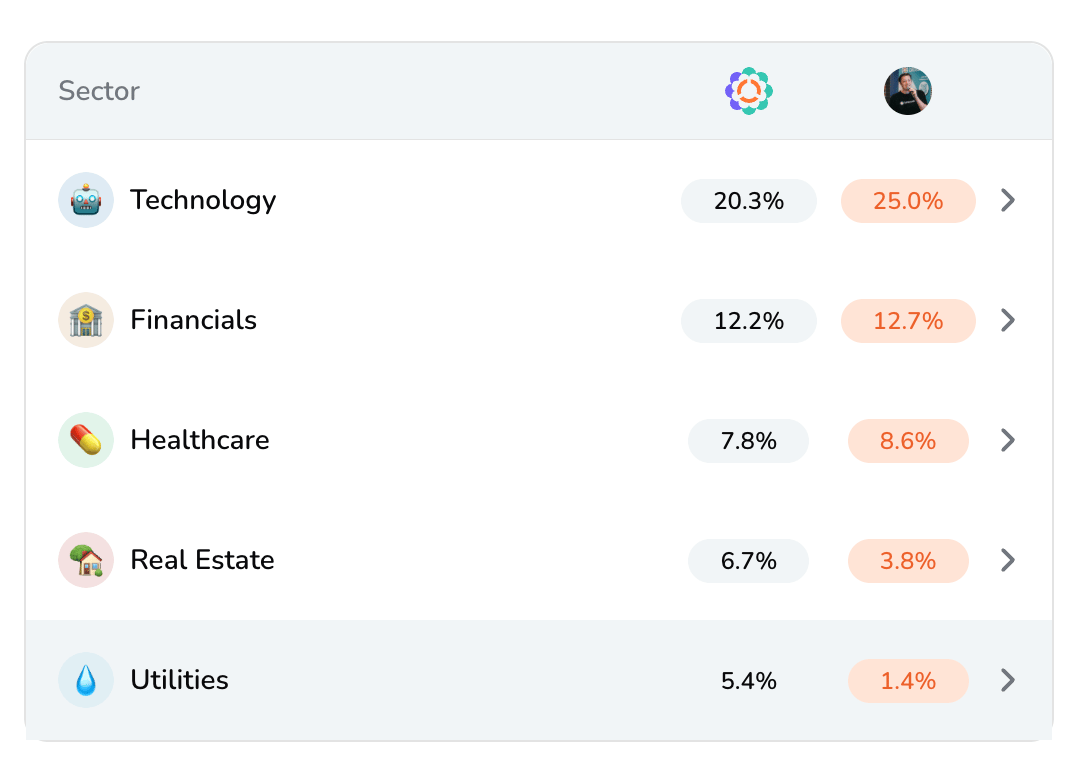

🌼 With only 1.4% of my portfolio allocated towards Utilities (compared to 5.4% for the average Blossom member), I’ll definitely be looking to pick up Utilities exposure this week, likely from a Utilities ETF like $ZUT or $HUTL since I’m more of an ETF guy.

Screenshot from Blossom PRO

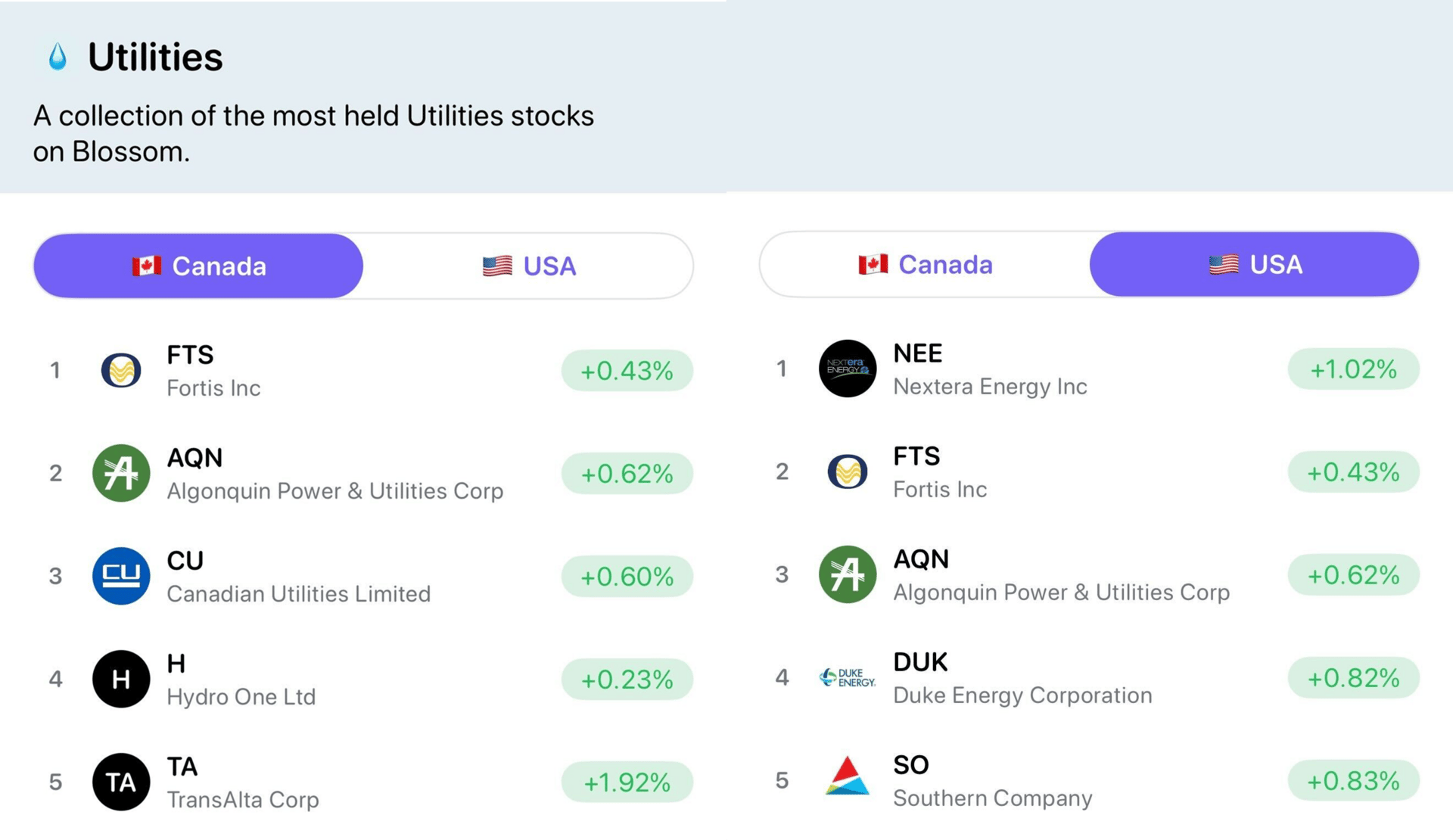

😎 If you’re more into individual stocks, you can see the most held Utilities stocks in Canada and the US by tapping on the ‘Sector Lists’ in the Markets tab of the Blossom app - here’s the top 5 as a preview:

UPCOMING EVENT

🥯 Ben Felix & The Plain Bagel Confirmed As Keynotes for the Blossom Investor Tour!

🥳 Repeating this message from last week since it’s such big news! PS. We’ve now sold ~50% sold out of the tickets for the tour (with still 8+ weeks away) so make sure you pick up a ticket before we run out!

🤩 Exciting news! We’ve officially confirmed two LEGENDS as keynote panelists for our Blossom Investor Conference in Toronto: Ben Felix and The Plain Bagel.

💡 In case you’re not familiar, Ben and Richard are two of the leading investing YouTubers in Canada, with a following of over 1.5M across their channels. In addition to their YouTube stardom, Richard is also a Chartered Financial Analyst, working for an investment management company in Ottawa, and Ben is the Chief Investment Officer at PWL Capital.

🎟️ Tickets are going fast so make sure to grab one for our Toronto event here or visit the new Blossom Investor Tour website for tickets to our stops in Calgary, Vancouver, and Montreal!

ALSO IN THE NEWS

🗞️ Other Key Headlines this Week

🗞️ This week there were quite a few important headlines, so to cover them all I’m going to do a rapid-fire 1-liner each rather than my usual 3-4 bullets each 😄

🤖 Nvidia ($NVDA) jumped +4.3% this week after securing US approval to resume H20 AI chip exports to China. The reversal could restore $15B in lost revenue and comes amid rare earth export relief from China.

🥤 PepsiCo ($PEP) is up +6% after Q2 earnings topped expectations. While North American sales remain soft, international growth and better-than-feared results kept full-year guidance intact.

🧠 TSMC ($TSM) rose +5% after reporting record Q2 profits up 60% YoY. AI chip demand remains strong, though the company flagged Trump’s tariffs as a looming risk for Q4 margins.

🚖 Lucid ($LCID) soared +33% after announcing a major robotaxi partnership with Uber and Nuro. The trio plans to roll out 20,000 autonomous Lucid vehicles on Uber’s network over the next six years.

🏪 Alimentation Couche-Tard ($ATD) jumped +10% after walking away from its bid to acquire 7-Eleven’s parent company, citing a lack of “constructive engagement.” Investors welcomed the move, as it avoided regulatory hurdles and unclear synergies.

📺 Netflix ($NFLX) fell -3% despite beating Q2 earnings. Full-year guidance was raised and ad revenue is still expected to double in 2025, but with shares already up 42% year-to-date, it wasn’t quite enough to meet investors’ very high expectations.

⚛️ Rigetti ($RGTI) surged +39% after announcing its upcoming 36-qubit quantum system achieved 99.5% fidelity. The system is set to launch on August 15 and represents a major leap in commercial quantum computing performance.

🐝 P.S. Make sure you follow The Daily Buzz account on Blossom to get these headlines on the day of!