- The Weekly Buzz 🐝 by Blossom

- Posts

- A Battle of Giants

A Battle of Giants

Will Google lose its dominance?

Google in Trouble? 😱

✅ Microsoft unveiled the newly-improved Bing.

❌ Google’s AI chatbot competitor blunders announcement.

Google has long dominated the search engine market, making Search a significant revenue driver.

Microsoft's Bing, and their partnership with OpenAI, have put Google’s dominance into question after a product demo that shows OpenAI's cutting-edge ChatGPT-3 technology integrated into its search engine.

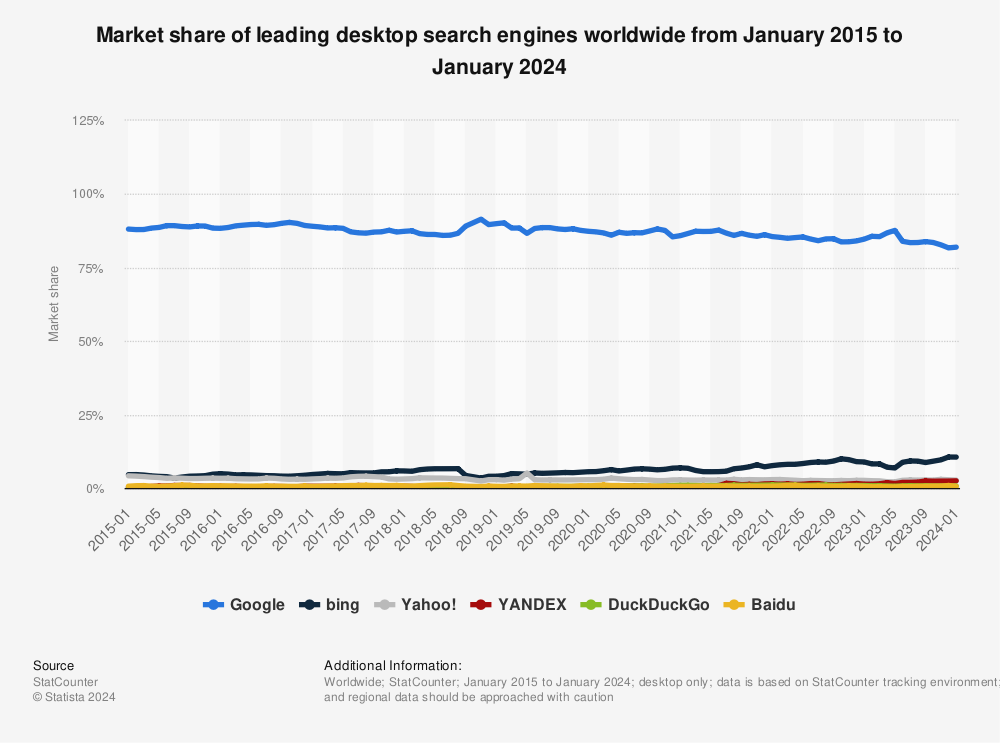

In an interview with The Wall Street Journal, Microsoft’s CEO emphasizes Bing’s underdog status in the market, with only 9% of the market share compared to 84% held by Google, saying, “all I need is a few more users while Google has to keep all their users and all their gross margin, I’m looking forward to that.”

Big Picture: Bing's integration of AI into search could give it the edge it needs to challenge Google's dominance.

While it remains to be seen how the search engine market will evolve, one thing is clear: the integration of AI technologies like ChatGPT-3 is reshaping the industry and forcing players to raise their game.

For a deeper dive, check out this great ColdFusion video trending at #13 on Youtube.

Canada’s Shocking Job Numbers 🤯

Last month, Canada added 150,000 jobs, ten times the amount estimated by Bloomberg economists, presenting a challenging situation for the Bank of Canada.

The rise in January was primarily seen in full-time positions (120,000+ jobs added), with “Accommodation and food services” growing the fastest.

Table: Graeme Bruce - Source: Statistics Canada - CBC News

Big Picture: The Bank of Canada faces a dilemma after the strong labor market figures.

The Bank of Canada’s "conditional pause" to evaluate the impact of its actions is looking increasingly unlikely as the recent rate hikes have done little to cool job growth. The strong job growth has spooked investors as fears rise about future hikes. The TSX is down ~0.6% after the news.

Top Discussions This Week 🎙

Powered by the Blossom Social app!

Should you buy AI stocks? 🤔

I’ve been seeing a lot of hype around AI stocks and I’ll be honest I’m not buying into it.

This is a perfect example of the dotcom bubble. You’re seeing a lot of companies coming up with websites that end with .Ai or .io (www.copy.ai)

During the dotcom bubble you had companies making a .com website and automatically that stock would rise 100% with absolutely no earnings & I fear a similar thing is happening now. If you want to invest in AI than make sure the fundamentals are solid for the company and that they generate revenue. Also don’t buy at the top come on 🤦🏽♂️

The Magic of Yield on Cost 🪄

…And if you're planning to stop investing in the next ten years, it's true you'll be way better off with the second option. But once you get past that x-year threshold, the dividend growing stock starts to make a lot more sense, since the compounding effect makes the growth exponential, as opposed to the linear growth of a high yield ETF. 🚀

To give you an example, if you invested 1,000$ in $AVGO in 2013, you would've been paid 21.32$ for that year. Eh, that's not much. Let's skip to today. You've kept your shares all of this time. This year, despite the fact that Broadcom only pays a 3.05% dividend yield, you will receive 516.27$ in dividends! That's huge, and that's without reinvesting dividends, and we're not even considering capital appreciation. 🤯

On the other hand, if you invested 1,000$ in a high yield covered call ETF 10 years ago, it's true that you would've been paid 100$ right away. But skip to today, you would still be paid 100$ for that investment. High yield covered calls ETFs are definitely not a bad investment, but if your investment horizon is very long, you might want to think twice about making it your main strategy! 🏹