- The Weekly Buzz 🐝 by Blossom

- Posts

- 🚀 Google Soars 12% After Key Lawsuit Win

🚀 Google Soars 12% After Key Lawsuit Win

Plus, Figma plunges 22% after first earnings report, Lululemon sinks 18%, and more...

TOP STORY

📈 Google Soars 12% After Key Lawsuit Win

🏖️ It was a short week in the markets, with all of us getting a much-needed stock market break for Labour Day, but in the 4-day markets were open, the headlines were buzzing.

👷 The biggest macro story of the week was the US jobs report, which showed a weakening economy with unemployment rising to a 4-year high of 4.3% as job growth slowed.

😰 While bad news for the market at large (and anyone looking for work), weak jobs data strengthens the case for the highly anticipated interest rate cuts from the Federal Reserve this month, so across the board, the indexes actually climbed a bit this week:

The S&P 500 ended the week up +0.33%

The Nasdaq-100 ended up +1%

The Canadian TSX index won the week, up 1.7%

〰️ But despite a relatively flat market overall, a ton of major players saw massive swings this week. A few of the stories that stood out to me:

Broadcom ($AVGO) soared +12.6% after strong earnings showed booming AI chip demand, with AVGO forecasting $6.2B in AI chip revenue for the upcoming quarter, and announcing a $10B custom chip deal with OpenAI

AMD sank -7.1%, as Broadcom’s momentum has Wall Street scared that customers looking for alternatives to Nvidia will opt for internal designs in partnership with AVGO instead of AMD chips.

Lululemon ($LULU) crashed -18% after reporting profit decline and the CEO saying he’s ‘not satisfied’ with the numbers and says products have become ‘stale’.

American Eagle ($AEO) in contrast rocketed up +45% after Sydney Sweeney and Travis Kelce’s ad campaigns drove strong profit growth.

Figma ($FIG) (which we’ll deep dive into as our second story today) posted its first-ever earnings since its IPO, falling -22% after reporting

⭐️ But across all the headlines, there was one massive story we need to cover, causing a huge swing in Blossom’s 3rd Most Held stock: Alphabet ($GOOGL) - with the stock soaring +12% this week to all-time-highs.

🚀 So let’s take a look at what’s going on with the search giant and why the stock is flying high.

👨⚖️ Judge Rules That Google Doesn’t Need to Be Broken Up

Alphabet investors have been on edge since last year, when Judge Amit Mehta ruled that Google illegally maintained a search monopoly, with the DOJ pushing for two key outcomes:

❌ Make Google divest its Chrome browser and Android operating system

❌ Ban Google from paying for default placement on devices and internet browsers

🧑⚖️ Well now, a year later, the verdict is in, and if looks like the fears were way overblown as the same judge has dealt what some critics are calling only a ‘slap on the wrist’. Ruling that:

💽 Google has to share data from its search engine with rivals

❌🤝 Google cannot enter into exclusive contracts relating to the distribution of its products, including Chrome, Google Assistant, and the Gemini app

⭐️ While this has some negative impact on Google, it’s nothing compared to what the DOJ was pushing for. Google will not have to break up any of its businesses and can continue paying distributors like Apple and Mozilla to be the default search engine for their respective browsers.

👏 Analysts Rejoice, Sending the Stock Soaring

😡 Big tech critics and competitors were furious with the decision, with the CEO of Epic Games giving a pretty hilarious comment:

“It’s like a defendant robbed a series of banks and the court verdict found them guilty, then sentenced them to probation under which they may continue robbing banks but must share data on how they rob banks with competing bank robbers”

🏆 But for Google shareholders, the week was a massive win, with the stock soaring 12% this week and even bringing Apple along with it, up 3% as Google and Apple’s partnership will remain intact.

📈 Analysts’ comments fueled the rally, saying the decision removed a “significant overhang” on the stock.

🎯 Wedbush even raised its price target from $225 to $245 and listed 3 reasons it's bullish on the stock:

1. The court decision removed ‘lingering risks’ associated with the worst-case outcome for the company

2. The impact of generative AI rivals such as OpenAI and Perplexity is fading (in Wedbush’s opinion)

3. And Google's leadership is "repositioning the business as a winner in the AI space, with strong demand trends and an acceleration in Cloud growth."

😰 While I was (and still am) a little nervous about Google’s search dominance fading as consumers switch to alternatives like ChatGPT, credit where credit is due, Google’s recent earnings (which I broke down here) were stellar, with Cloud revenue growing 32% and Search revenue growing 12% signalling that at least for now, AI has had a largely positive impact on Alphabet.

🤖 Saved by the AI

Ironically, the AI competition from OpenAI and Perplexity (which some have pointed to as the Google-killer) actually helped Google massively in this case, with the judge saying that generative AI has made search more competitive.

This deeply undermined the DOJ's case for carving up Google's empire, which could have seen products like YouTube or Chrome become totally independent companies.

✨ So, while Google certainly still has struggles ahead, I think it’s safe to say that Google investors have plenty of reason for optimism this week, with Brad Erickson from RBC summing things up nicely:

“The path for compounding earnings growth along with multiple expansion hasn't looked this clear in some time.”

👀 Ok, now that we’ve covered Alphabet, let’s turn our attention to another stock I’ve been wanting to dive into for some time now: Figma. But first, a quick word from this week’s sponsor, Global X Canada!

PRESENTED BY GLOBAL X CANADA

💸 Global X Covered Call ETFs: Growth You Want, Income You Need

💸 Passive income is popular but making a side hustle succeed is another challenge altogether.

🍁 More Canadians are looking for reliable income while still participating in long-term equity growth. What if you could put your passive income on autopilot with Covered Call ETFs?

💰 Global X offers Canada’s largest suite of Covered Call ETFs, with nearly $4 billion in total assets1.

✨ Reasons to consider Global X:

🧑💼 Experienced Management at a Low Cost: As one of Canada’s longest-running covered call ETF providers, our disciplined, index-focused approach makes Global X Covered Call ETFs among the lowest-cost options available to Canadian investors2.

🌍 A Global Approach to Covered Call Coverage: Our nearly 40 ETFs span the S&P 500®, Nasdaq-100®, and key Canadian sectors such as banks and energy. ENCC, our Canadian Oil & Gas Equity Covered Call ETF, remains the largest and most popular energy covered call ETF in Canada today3.

🪙 Permanent Innovation, New Strategies: We continue to expand investor access to yield and opportunity with thoughtful tools like light leverage and semi-monthly distributions—exemplified by our Bitcoin covered call ETFs, BCCC and BCCL.

💡 Not all Covered Call ETFs are created equal. Your portfolio matters. That’s where Global X makes a real difference.

[1] As at July 31, 2025. [2] Source: Global X as at September 3, 2025. [3] Bloomberg

BIG TECH

😰 Figma Sinks 22% After Earnings Show Slowing Growth

🎨 First off, in case you're unfamiliar, Figma ($FIG) is a platform for collaborative design and product development.

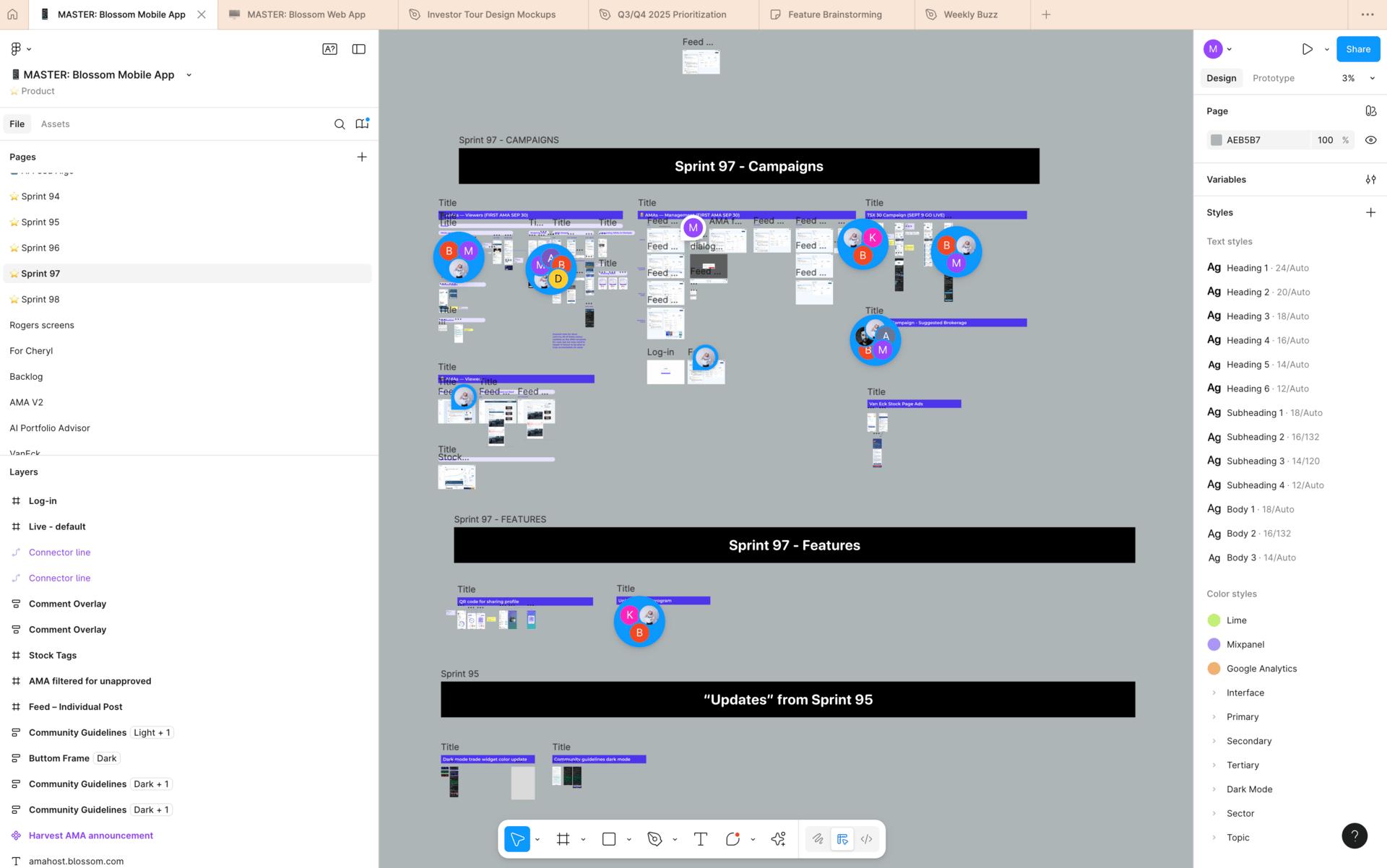

📲 All of Blossom for instance has been designed using Figma – me and Sophie design the wireframes for new features on Figma and our developers reference it to make those designs a reality (see screenshot below of the Figma chaos that goes into each new feature update).

🛎️ Figma’s IPO

📈 Figma’s business model is a simple ‘software as a service’ where customers pay per seat, meaning Figma’s revenue grows as the company grows.

💰 Figma has had an interesting last few years – in 2022, Adobe tried to acquire them for $20B, but the deal ended up being blocked by regulators, so this year Figma instead decided to IPO - with the company hitting a peak valuation of $68B.

🏆 Figma’s stock soared +250% on its first day of trading - setting a record for the largest-ever first-day gain for a U.S.-traded company raising over $1 billion, but since then the stock has been hurting, falling -39% between the IPO and last Friday, and another -22% just this week to a $27B valuation. So what’s going on?

🤑 Figma Earnings

Well this week Figma reported it’s first earnings as a public company, and on the surface, Figma’s earnings look great with quarterly revenue hitting $249.6M, up 41% from last year.

In the words of Figma’s CFO:

"We delivered best-in-class revenue growth and positive operating margin as we kept investing in AI and expanded our platform. Our 129% Net Dollar Retention Rate also shows that our customers are continuing to deepen their investment in Figma's platform."

👎 But across the board, Wall Street was mostly disappointed - with Bank of America, Morgan Stanley, RBC Capital, and Wells Fargo all lowering price targets.

🐢 The reason? While 41% revenue growth seems high, it marks a clear deceleration in growth:

In 2024, its revenue jumped by 48% compared to 2023.

In Q1, revenue grew by 46%

So the 41% was already a slowdown, but to make matters worse, Figma projects just 33% growth for Q3.

😰 This slowdown fuels fears that generative AI could be eating Figma’s lunch, which some say makes it difficult to justify the high 33x Price-Sales ratio that Figma sits at, even with the recent stock drops.

🤔 A Sign of Real Trouble? Or Just Expected Volatility?

🚨 And while alarm bells are going off for some analysts, others, like analysts at Piper Sandler, beleive this is just a correction from ‘hyper-volatility’ the stock has seen since its IPO, with another analyst adding:

'“There were no big surprises in Figma's second-quarter results as it continues to deliver robust growth with more monetization opportunities to come down the road”

🤑 Cathie Wood, the high-profile fund manager of Ark Invest, also took the opportunity to buy 100,000 shares, signalling confidence that the drawdown was an overreaction.

🐻 Since I haven’t had a chance to dive too deeply into Figma, I don’t feel confident enough to take a stance one way or another, but overall on Blossom, it looks like the community was largely bearish/pessimistic on the stock, with 335 of you selling and only 252 buying, leaving Figma with 965 holders.

🔍 From my perspective, the product is incredible and one of the essential tools in Blossom’s tech stack, so when I have a chance, I definitely plan to research this one a bit harder and am excited to read your thoughts on the stock on Blossom!

PRESENTED BY CIBC CDRS

🍁 Global Stocks in CAD$ – Right at Your Fingertips

🌎 Investing in the world’s leading companies should be easy and accessible for everyone. With CIBC’s CDRs, you can access shares of top global brands — like LULU, ASML and UNH — directly from your online brokerage, all in Canadian dollars. No currency conversion, no international hurdles, just straightforward investing from the comfort of your home.

Why Choose CIBC’s CDRs?

💸 Affordable Access: Own a piece of the world’s largest companies at a fraction of the cost.

💱 Currency Risk Mitigation: The built-in notional currency hedge protects your returns from exchange rate fluctuations.

💧 Liquidity You Can Rely On: CDRs pull liquidity from their underlying global stocks, just like ETFs. With market makers ensuring fair pricing, you can trade with confidence.

⭐️ Ease of Trading: Buy and sell CDRs just like any stock or ETF.

Accessibility is at the core of CDRs—fractional shares mean you don’t need a large portfolio to get started. And with seamless online trading, you can diversify globally anytime, anywhere. CIBC’s CDRs are designed to break down barriers, opening up access to global investing for all Canadians.

IN PARTNERSHIP WITH CBOE CANADA

🚨 ETF Alert: Purpose Launches 10 New Yield Share ETFs!

⭐️ Single stock ETFs have been soaring in popularity on Blossom, with new tickers being launched right and left to support the growing demand, and this week is no exception - with Purpose Investments launching 10 new Yield Shares ETFs covering the biggest stocks in Canada, including:

+ 7 more with a covered call strategy on 50% of the portfolio, combined with a modest 25% leverage. Check them all out here!

*See Purpose Investments Disclaimer at the end of the newsletter

FROM THE BLOSSOM COMMUNITY

⭐️ Featured Discussions this Week

👇 Click to see the full post!

Purpose Investments Disclaimer

*Yield Shares funds are designed to provide "enhanced" or higher monthly distributions compared with the underlying common stock, which pays a relatively lower or no distributions.

Commissions, trailing commissions, management fees, and expenses may all be associated with investment fund investments. Please read the prospectus and other disclosure documents before investing. Copies of the prospectus can be obtained from purposeinvest.com. There can be no assurance that the full amount of your investment in a fund will be returned to you. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated. Fund distributions and their frequency are not guaranteed and may vary at the sole discretion of Purpose Investments.