- The Weekly Buzz 🐝 by Blossom

- Posts

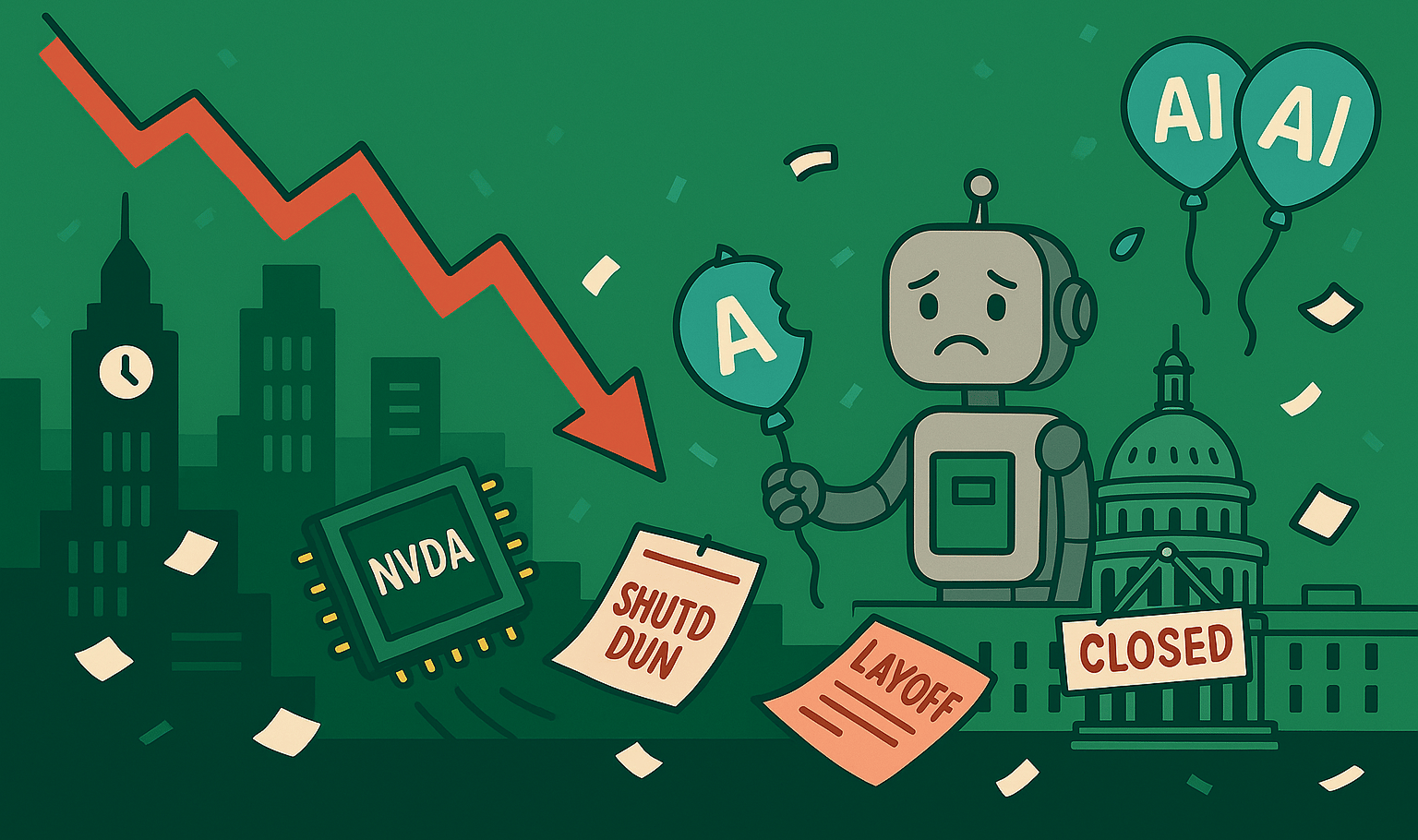

- 😰 Market Has Its Worst Week Since April As Nvidia Falls 10%

😰 Market Has Its Worst Week Since April As Nvidia Falls 10%

Plus, 'Big Short' Michael Burry Bets $1.1B Against the Market, Medicare expands to obesity drugs, and more...

TOP STORY

😰 Stock Market Has Its Worst Week Since April

😬 Last week, I wrote about how Amazon ‘saved the market’ with its strong earnings report… but I might have spoken too soon, as this week the markets had their worst week since April:

The S&P fell -2.2%

The Nasdaq-100 fell -4%

The TSX fell -1.3%

🤔 So before we dive into some of the other big stories this week (like Medicare expanding to obesity drugs, Apple’s partnership with Google for Siri, and rumours of an OpenAI IPO), let’s talk about what’s going on with the market and the reasons behind the drop:

👎 Weakening Consumer Sentiment

⚠️ Due to the government shutdown, investors haven’t been getting the important employment data they usually use as a pulse on the economy, but a few data points this week showed some red flags:

Layoffs have reached their highest level since 2009, totalling 153,074 in October, 175% higher than October last year. Companies in the tech sector led the charge, announcing 33,281 cuts, 6x the number in September.

A survey from the University of Michigan revealed Friday that consumer sentiment is nearing its lowest level ever

❌ The government shutdown, which is now the longest in American history, is also starting to pose a threat to economic activity, hurting consumer sentiment even more:

“With the federal government shutdown dragging on for over a month, consumers are now expressing worries about potential negative consequences for the economy. This month’s decline in sentiment was widespread throughout the population, seen across age, income, and political affiliation.”

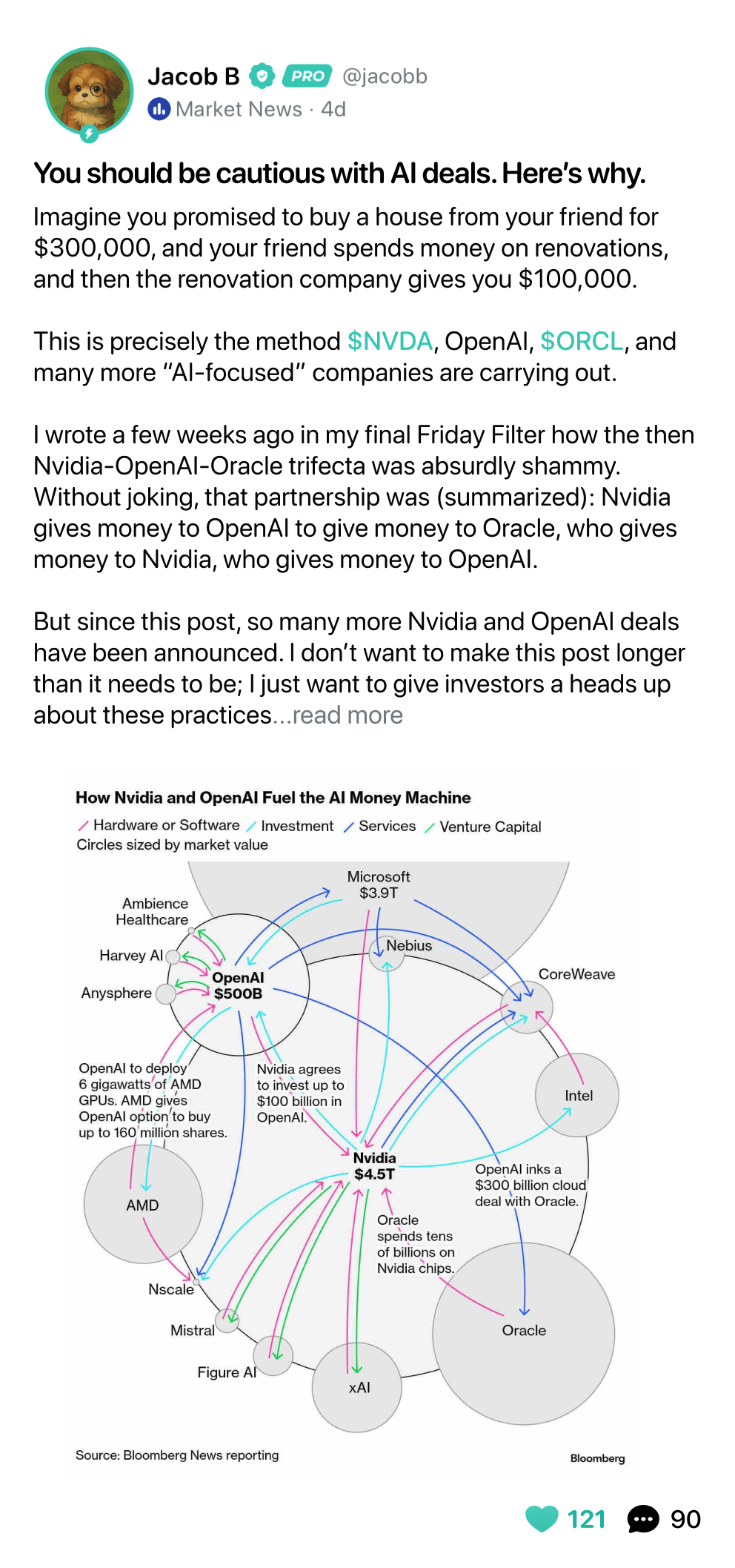

🫧 Continued Worries About An AI Bubble

🤖 Another reason for the rough market this week was drops across the AI players, which pulled down the market as a whole:

Nvidia fell -9.6%

AMD fell -9.9%

Oracle fell -9.7%

🧼 These drops erased all of last month’s gains, but it’s worth noting that all of the above are still well overperforming the S&P 500 year-to-date.

🫧 I’ve talked extensively about whether we’re in a bubble, and some of this drop is likely due to continued worries about AI stocks being overvalued.

🔄 But as far as I can tell, there wasn’t anything ‘new’ that happened this week to spark the sell-off, with some analysts saying that it’s likely just a healthy ‘rotation’ from the high-flying AI stocks to other sectors:

“You have had a bit of a rotation, which has been helpful in the value stocks, which kind of leads me to believe that the sell-off isn’t overly concerning. AI spending is still here.”

💡 Bennett’s comments are a good reminder not to panic in times like this. With tech stocks outperforming the market so aggressively this year, and valuations soaring, it’s natural, and probably a good thing to see a bit of a pullback (especially if you’re well diversified), with one expert saying:

The Nasdaq’s gone up 40% off the bottom in April. The market was kind of looking for a reason for a breather. This week, what you saw across the market is everybody looking for an excuse to sell the trade. I think it’s healthy. We’re taking some of the air out of the bubble.

🫧 But even with the drop this week, many commentators fear the ‘bubble popping’ is just beginning.

🎰 Michael Burry, for example, made famous by his prediction of the housing market crash in 2008, revealed a $1.1B bet against Nvidia and Palantir this week in a massive bet against AI.

❓ The question of ‘are we in a bubble’ has become a bit of a never-ending debate, and is something I’ve already talked about in the Buzz again and again, so I won’t rehash the same points. But if you want to watch more on the topic, check out this awesome video by the Plain Bagel that mirrors a lot of my thoughts.

🔦 A Light At the End of the Tunnel?

📈 While it was a rough week overall, the second half of Friday showed some hope as stocks recovered slightly on news of a proposal to end the government shutdown.

👨⚖️ The Senate even held a rare weekend session yesterday and is expected to reconvene today, with the Senate Majority Leader saying they will continue meeting until the government reopens.

🤞 An end to the shutdown would be good news for investors as it would likely lift consumer sentiment and ease some of the uncertainty plaguing the market, so fingers crossed on a speedy resolution.

🤿 All right, now that we’ve covered the drop this week, let’s dive into some of the other big stories this week, but first, a quick word from this week’s sponsor Guardian Capital.

SPONSORED BY GUARDIAN CAPITAL

🏆 Guardian Capital LP Wins Three LSEG Lipper Fund Awards, Canada 2025

📣 We’re thrilled to announce that Guardian Capital LP has won three 2025 LSEG Lipper Fund Awards here in Canada based on exemplary results within both Canadian equity and fixed income.

Our portfolio management teams have been managing assets for institutional clients and retail investors for decades and these awards are a testament to the impressive results our teams have been able to deliver.

👑 Best Bond Fund Family Group Over 3 Years – View our award-winning Fixed Income Solutions

👑 Best Canadian Equity Fund Over 3 & 5 Years – Guardian Canadian Focused Equity Fund

Check out our dedicated Fund Spotlight pages linked above to learn more about these strategies and see the benefits they may offer for your portfolios.

🎉 Congratulations to our portfolio management teams, and thank you for your continued support!

Guardian Canadian Focused Equity Fund (series F) was awarded the 2025 Canada LSEG Lipper Fund Award for Best Canadian Equity Fund over 3 and 5 years, respectively, for the period-ended July 31, 2025. The corresponding LSEG Lipper Leaders Ratings for Series F of the Fund for the applicable periods are: 5 (3 years, 92 Funds), 5 (5 years, 79 Funds) n/a (10 years) and 5 (overall).

Source: LSEG as at July 31, 2025.

Performance for the Series F of the Fund for the period-ended July 31, 2025 are: 27.8% (1 year), 26.2% (3 years), 20.1% (5 years), n/a (10 years) and 14.5% (since inception; May 14, 2029). Other series of the Fund have different fees and expenses and performance and ratings will vary. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemptions, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. Performance is calculated net of fees. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

*See Guardian Capital LP Footnotes and Disclaimers, including the Lipper Fund Award methodology, at the end of the newsletter.

IN OTHER NEWS

🗞️ Top Headlines of the Week

✨ Outside of the market dip this week, there was actually a ton of big headlines to cover, so here’s the rundown!

🛍️ Shopify Dips 13% After Earnings Despite 32% Revenue Growth

💰 This week, Shopify ($SHOP) reported earnings, with Q3 2025 revenue up 32% from last year to ~$2.84 billion, beating expectations

😰 Despite this, gross margin slipped from 51.7% to 48.9% driven by higher research and development costs related to AI, leading to a miss on operating income (and driving the stock drop this week).

🚀 Many experts feel the drop is overblown and are bullish on Shopify’s AI investments. According to Shopify president Harley Finkelstein, Shopify's AI assistant Sidekick (which uses AI for tasks such as setting up discounts or creating sales reports) is "quickly becoming the default way merchants get things done."

🤖 Even though a 13% drop sounds like a lot, Shopify is still up 42% year-to-date, with a recent rally after the announcement of its "Instant Checkout" partnership with OpenAI in late September. Soon, Shopify merchants will be able to sell directly within ChatGPT conversations in the U.S.

🤑 Personally, I’m still bullish on SHOP and plan to continue holding the 3% of my portfolio I have invested in the stock (which has given me a +261% return since buying a few years ago).

🍎 Apple to Pay Google $1B Annually to Power Siri

💰 Apple (AAPL) is finalizing a deal to pay Alphabet ($GOOG) $1 billion per year to use Gemini to power its new Siri, with Gemini winning out against OpenAI and Anthropic.

💽 The Gemini model reportedly contains 1.2 trillion parameters, compared to Apple’s in-house offering at ~150 billion parameters.

🗂️ Under the deal, Gemini will handle Siri’s “summarizer” and “planner” functions, complex tasks like synthesizing information and executing multi-step requests, while Apple continues to run other features via its own models.

😬 Apple has been under pressure to catch up in the AI race, and some see the move as a sign of weakness and as proof that it has lagged behind in AI development.

👍 But others call it a “reasonable medium-term fix” in Apple’s efforts to catch up, and most analysts reacted positively to the news, with analyst Dan Ives calling the move ‘potentially transformative’.

📉 Both Apple and Google ended the week down ~1%, but this is likely due to the mini-tech crash we talked about earlier.

💉 Healthcare Stocks Jump As Medicare Expanded to Obesity Drugs

🤝 This week Trump announced deals with Eli Lilly ($LLY) and Novo Nordisk ($NVO) to slash the prices of some of their obesity drugs, while also adding Medicare coverage for some of these drugs.

💰 The price drop is expected to be a short-term revenue hit for the drug giants, but will increase sales long term by broadening the market for the drugs and driving more private insurers to cover them.

📈 Eli Lily is up +6.7% this week on the news, but Novo Nordisk fell -8.5%, still being dragged down from poor Q3 earnings and increasing competition in the obesity drug market.

🤑 Rumours of An OpenAI IPO Squashed by CFO

❌ Despite rumours earlier this week that OpenAI was laying the groundwork for a public listing valued at up to $1T in 2026, OpenAI’s CFO Sarah Friar said this Wednesday that an “IPO is not on the cards right now.”

😰 The rumours come after growing concerns about OpenAI’s ability to pay for the massive financial commitments it has made with Nvidia, AMD, Broadcom, and others, with the CFO causing concern this week after suggesting the US government should ‘backstop’ the firm’s funding deals.

💰 When pressed on how OpenAI will pay for its massive spending commitments, Sam Altman got defensive, saying “enough" and that “revenue is growing steeply.”

SPONSORED BY QUESTRADE

🌒 Trade on Your Schedule: Unlock After-Hours Opportunities

🌟 The world's markets are always moving, and so can your investments with Questrade's new overnight trading hours. With overnight trading, you gain the power to react to global events and market shifts beyond standard market hours, putting you in control of your financial journey.

🔔 Imagine seizing opportunities as they emerge, even after the closing bell. While many traditional brokers restrict trading to conventional hours, Questrade now offers overnight trading, allowing you to buy and sell investments for 22 hours a day, from 4am to 2am ET. This wider window provides unparalleled flexibility and responsiveness compared to most other brokers. You can buy and sell US stocks and ETFs outside traditional market hours, turning any time of day into one you can profit from. This means you can build your portfolio on your schedule, react instantly when news breaks, and spot trends first, beating the opening bell rush.

💪 By embracing overnight trading, you gain a significant advantage, transforming the way you interact with the markets and putting you in a stronger position to achieve your financial goals.

💰 Open a Questrade account today and get a $50 bonus

Use the promo code ‘Blossom’ and get $50 when you open a new Questrade account.

Guardian Capital Disclaimer

About the Lipper Methodology

The LSEG Lipper Fund Awards for Canada are granted annually and highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The LSEG Lipper Fund Awards are based on the Lipper Leaders Rating for Consistent Return, which is an objective, quantitative, risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible Classification wins the LSEG Lipper Fund Award that year. LSEG Classification uses CIFSC categories in Canada, rather than Lipper Global classifications. Canadian Investment Funds Standards Committee (CIFSC) is a Canadian independent organization that defines the categories of funds.

LSEG Group is a leading global financial markets infrastructure and data provider. For more information please refer to their website at: www.lipperfundawards.com. Although LSEG Lipper makes reasonable efforts to ensure the accuracy and reliability of the data used to calculate the awards, their accuracy is not guaranteed. From LSEG Lipper Fund Awards © 2025 LSEG. All rights reserved. Used under license.

Lipper Leaders Rating for Consistent Return

The Lipper Leaders Rating System includes Lipper Ratings for Consistent Return, which reflects a fund’s historical risk-adjusted returns relative to funds in the same classification, and takes into account both short- and long-term risk-adjusted performance, together with a measure of a fund's consistency. The measure is based on the Lipper Effective Return computation. Effective Return is a risk-adjusted return measure that looks back over a variety of holding periods (measured in days, weeks, months, and/or years). The overall calculation is based on an equal-weighted average of percentile ranks of the Consistent Return metrics over three, five-, and ten-year periods (if applicable). The highest 20% of funds in each classification are named Lipper Leaders for Consistent Return, with a rating of 5, the next 20% receive a rating of 4, the middle 20% are rated 3, the next 20% are rated 2, and the lowest 20% are rated 1. Lipper Leaders Ratings are subject to change every month.

Lipper Asset Class Group Awards

Asset class group awards for Canada will be given to the best fund family group with at least three equity, bond or mixed-asset portfolios in the respective asset class. The highest average decile rank of the three years’ Lipper Leader for Consistent Return (Effective Return) measure of the eligible funds per asset class group will determine the award winner over the three-year period. In cases of identical results, the higher average percentile rank will determine the winner.

This communication is for informational purposes only and does not constitute investment, financial, legal, accounting, tax advice or a recommendation to buy, sell or hold a security and should not be considered an offer or solicitation to deal in any product mentioned herein. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. It is only intended for the audience to whom it has been distributed and may not be reproduced or redistributed without the consent of Guardian Capital LP. This information is not intended for distribution into any jurisdiction where such distribution is restricted by law or regulation.

Please read the prospectus, Fund Facts or ETF Facts before investing. Important information, including a summary of the risks, about each Guardian Capital mutual fund and exchange traded fund (“ETF”) is contained in its respective prospectus. Commissions, trailing commissions, management fees and expenses all may be associated with investments in mutual funds and ETFs. You will usually pay brokerage fees to your dealer if you purchase or sell units of an ETF on a stock exchange. If the units are purchased or sold on a stock exchange, investors may pay more than the current net asset value when buying units of the ETF and may receive less than the current net asset value when selling them. Mutual fund and ETF securities are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. Mutual funds and ETFs are not guaranteed, their values change frequently, and past performance may not be repeated.

The opinions expressed are as of the published date and are subject to change without notice. Assumptions, opinions and estimates are provided for illustrative purposes only and are subject to significant limitations. Reliance upon this information is at the sole discretion of the reader. This information is subject to change at any time, without notice, and without update. This document may also include forward-looking statements concerning anticipated results, circumstances, and expectations regarding future events. Forward-looking statements require assumptions to be made and are, therefore, subject to inherent risks and uncertainties. There is significant risk that predictions and other forward-looking statements will not prove to be accurate. Investing involves risk. Equity markets are volatile and will increase or decrease in response to economic, political, regulatory and other developments. Diversification may not protect against market risk and loss of principal may result. Certain information contained in this document has been obtained from external parties which we believe to be reliable, however we cannot guarantee its accuracy.

Guardian Capital LP is the Manager of the Guardian Capital Funds and ETFs. Guardian Capital LP is wholly-owned subsidiary of Guardian Capital Group Limited, which is a publicly traded firm listed on the Toronto Stock Exchange. For further information on Guardian Capital LP and its affiliates, please visit www.guardiancapital.com. All trademarks, registered and unregistered, are owned by Guardian Capital Group Limited and are used under license.