- The Weekly Buzz 🐝 by Blossom

- Posts

- 📉 Meta Crashes 13% After Earnings As Investors Question AI Spending

📉 Meta Crashes 13% After Earnings As Investors Question AI Spending

Plus, Google jumps 6% after cloud revenues soar, and Microsoft dips after earnings...

BIG TECH EARNINGS

📉 Meta Crashes 13% After Earnings As Investors Question AI Spending

🥳 It’s Big Tech earnings season, so it’s time for our special edition Weekly Buzz to keep you updated on what’s going on with the tech giants!

⭐️ Apple and Amazon report earnings tomorrow (so I’ll cover those in the regular Sunday edition), but Google, Microsoft, and Meta have already reported, so let’s dive in…

📉 Looking at the stock prices, since earnings:

Meta ($META) tanked -13%

Google ($GOOG) jumped 6%

Microsoft ($MSFT) fell -2% (but is still up ~0.6% this week)

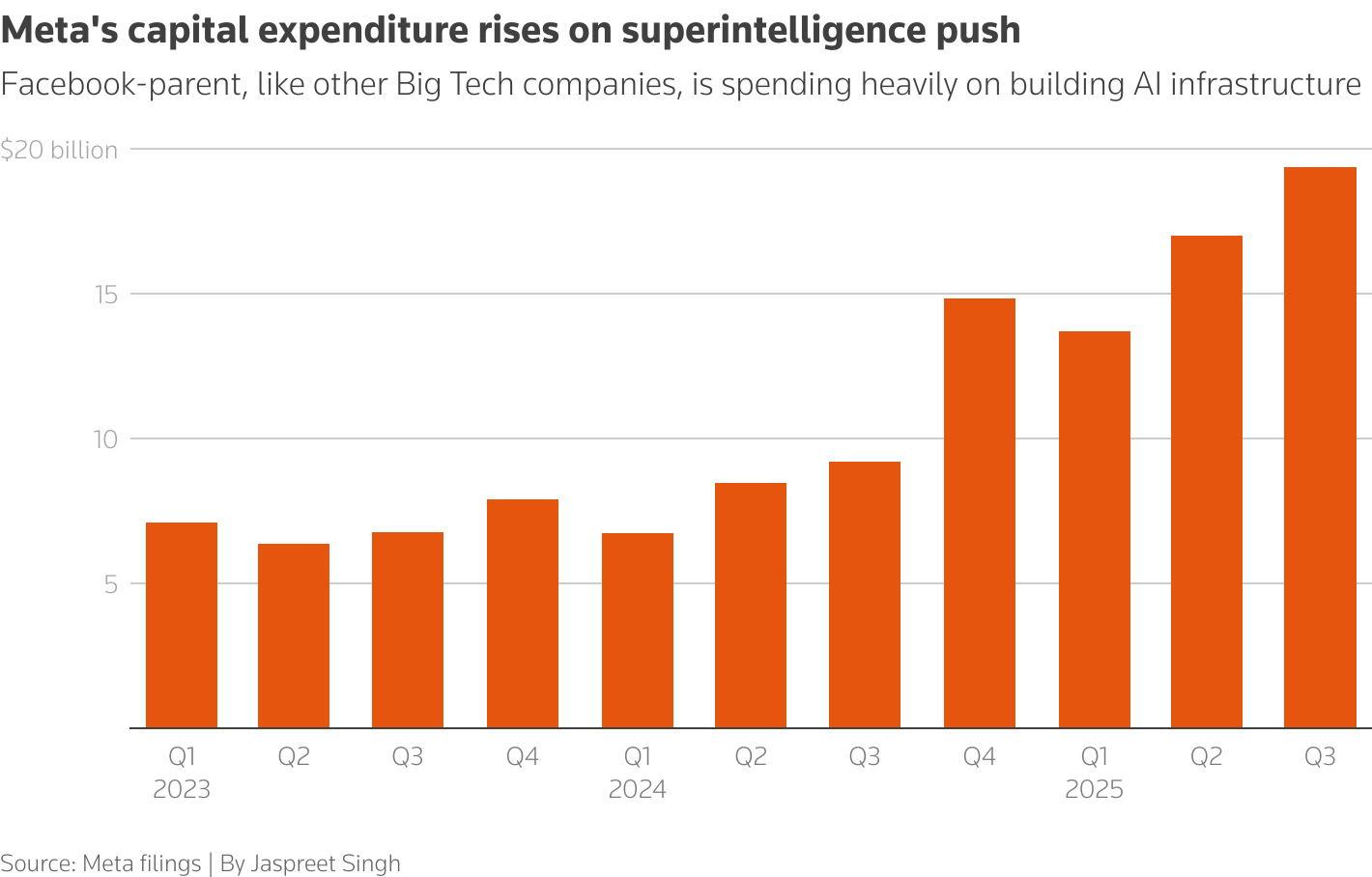

💰 The broader theme across the 3 tech giants was the AI spending spree, with the 3 companies spending $78B on AI last quarter.

🤔 And with such massive spending, the big question on investors’ minds is whether this aggressive AI spending is seeing returns…

🔍 And whether you hold one of these 3 stocks or not, the answer has implications for the whole market, so let's break down each earnings report and see what it means for the market at large.

📊 Meta Earnings Breakdown

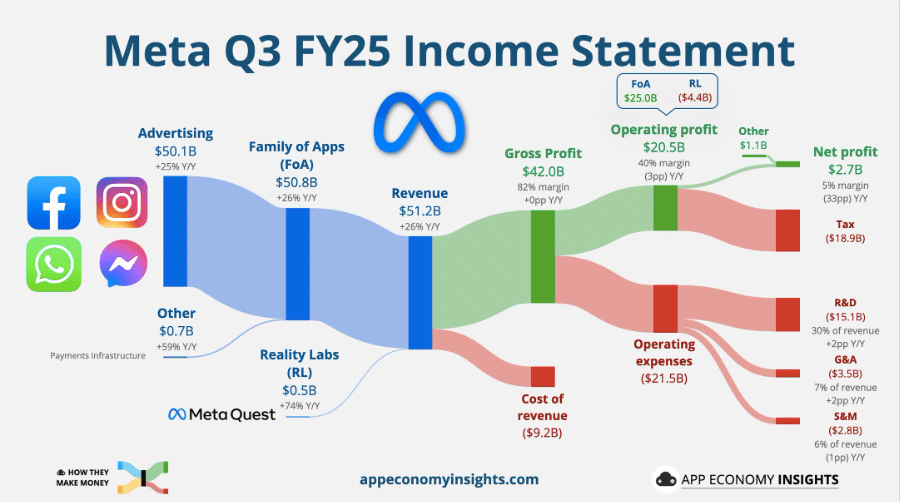

✅ Q3 Revenue was $51.2B, 4% higher than expected and up 26% from last year - the company’s highest revenue growth since Q1 2024

✅ Earnings per Share was $7.25, 8% higher than expected

✅ Daily Active Users grew to 3.54B, 8% higher than last year

🎯 For Q4, Meta projected revenue of $56 to $59 billion, above analysts’ expectations.

💰 The AI Money Pit

🧐 Ok, with such a glowing earnings report, why is the stock falling?

🤖 Well, most analysts and reporters are saying the likely culprit is the ever-increasing AI spending, with investors growing impatient to see a return.

💰 This quarter, Meta once again raised its estimates for 2025 AI capital expenditures, from a range of $66B to $72B to $70B to $72B.

🛡️ Zuck defended this spending, reiterating that underinvesting is a bigger risk than overinvesting:

“It’s pretty early, but I think we’re seeing the returns in the core business. That’s giving us a lot of confidence that we should be investing a lot more, and we want to make sure that we’re not underinvesting.”

🤔 But of course, Meta isn’t the only one spending buckets of cash on AI, so why is its stock falling when Google and Microsoft are still on the rise?

☁️ Well, most of Microsoft and Google AI expenses are going towards the cloud, meaning they’re selling that computing power to others, and seeing massive gains in their cloud businesses as they can service AI use cases across sectors for essentially any company or start-up.

🤷♂️ For Meta, the AI payoff is less clear. The main benefit so far seems to be better-targeted advertising, and perhaps projects like Vibes, Meta’s feed for AI-generated videos, but the risk of overspending is certainly much greater than the cloud providers, which is likely why Meta is under a bit more scrutiny.

🏦 Big One-Time Income Tax Hit

The other likely reason for the stock drop was a big $15.93 billion one-time tax charge as a result of Trump’s One Big Beautiful Bill Act.

Meta says it actually expects the law to result in “a significant reduction” in its U.S. federal cash tax payments for the rest of 2025 and future years, but the big hit made headlines and likely spooked investors a bit.

👓 AI Glasses Still In Early Days

👓 Another Meta product that’s been making headlines is its $799 Meta Ray-Ban Display glasses, unveiled in September with a built-in display and an accompanying wristband with neural technology

💸 While still early days, Zuck is confident that these will be a ‘profitable investment’ and shared that the product is sold out with demo slots booked through the end of November.

👀 With 98% of Meta’s revenue still coming from advertising, it will be interesting to see if Meta can diversify its revenue streams with hardware in the coming years.

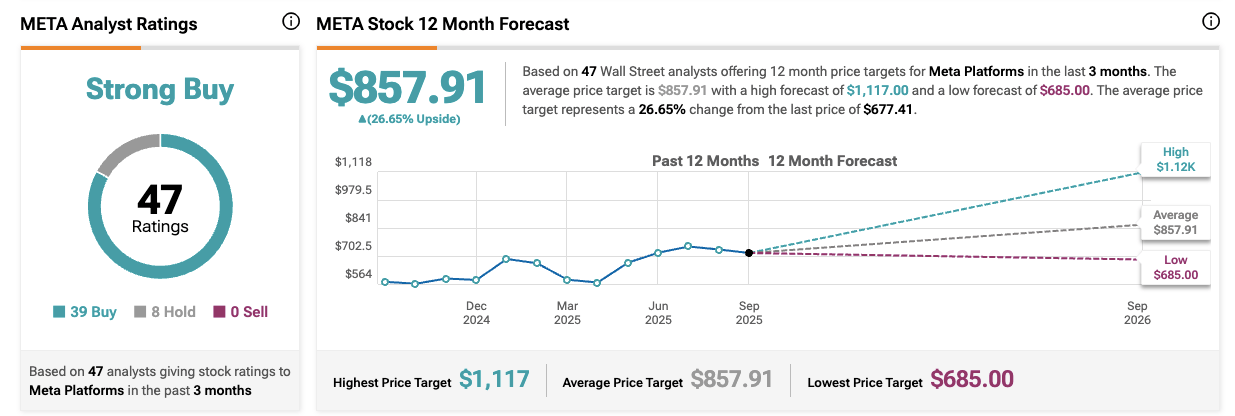

👨💼 Analyst Reactions

⭐️ Despite the hiccups this quarter, analysts continue to be very optimistic on Meta, with the stock rated a Strong Buy across 47 analysts.

⚠️ But some did flag concerns this quarter over the AI spending and downgraded their ratings,

Bernstein said the AI spending reminded them of the “Metaverse days”, lowering their price targets from $915 to $850

Oppenheimer Group downgraded Meta’s rating from outperform to perform, also saying that Meta’s “massive AI spending with no known revenue opportunity” mirrored its 2021/2022 Metaverse spending

✨ Still others say the company has earned the right to invest and argue that the dip creates a buying opportunity.

🙋♂️ To me, it’s interesting Meta is under fire for its AI investments this quarter, as this has been a trend at least for the past 2 years with limited pushback. It makes me wonder if investors are starting to put AI spending under more scrutiny with the ever-increasing calls that the market is in a bubble…

💡 Before we jump to conclusions, let’s take a look at Google and Microsoft’s earnings and what they tell us about the AI-driven markets, but first, a quick word from this week’s sponsor BMO ETFs!

SPONSORED BY BMO ETFS

⭐️ Why BMO Broad Market ETFs Are a Smart Investment Solution

🔍 If you're looking for a simple, low-cost way to invest across entire markets, BMO’s broad market ETFs are a powerful solution. These ETFs offer:

📊 Instant diversification across hundreds of companies

💸 Low management expense ratios (MERs) — for example:

Transparent holdings and daily pricing

Liquidity and flexibility, traded like stocks

Trusted expertise from one of Canada’s largest ETF providers, with over $110B in AUM

Whether you're building a core portfolio or starting out as a DIY investor, BMO broad market ETFs make it easy to invest with confidence.

*See BMO ETFs Disclaimer at the end of the newsletter

BIG TECH EARNINGS CONT.

☁️ Google and Microsoft See Cloud Businesses Soar

🤖 Both Google and Microsoft beat earnings, with both revenue and earnings beating expectations, but all eyes were on one thing - AI-driven cloud revenues.

📊 On that front:

Microsoft Intelligent Cloud unit reported $30.9B in revenue, with its Azure cloud business recording growth of 40%

Alphabet reported $15.15B in Google Cloud revenue, 34% higher than last year

💰 Like Meta, both companies increased their AI spending, with Alphabet increasing it’s capex projection from $75B to $85B and Microsoft saying its capex growth rate for fiscal 2026 will be above the rate in 2025 (despite previous statements that there would be a slowdown in growth).

📈 Still, both companies justified this spending saying they can’t meet the demand for AI and other services, even after the billions in spending in recent quarters.

“I thought we were going to catch up. We are not. Demand is increasing. It is not increasing in just one place. It is increasing across many places.”

✅ Because of this, the two tech giants are under a bit less scrutiny than Meta, and overall, while the earnings drew some concerns, the booming cloud businesses are a good sign for the AI-driven markets.

✈️ We’ll dive more into this on Sunday when we talk about Amazon’s and Apple’s earnings, but I have a flight to catch in 5 minutes to India for our CTO Kartik’s wedding, so that’s all I have time to cover for now! 😅

✍️ Written by Max, CEO of Blossom (@maxstocks on Blossom)

BMO Exchange Traded Funds Disclaimer

This communication is sponsored by BMO Exchange Traded Funds.

This communication is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.