- The Weekly Buzz 🐝 by Blossom

- Posts

- 🚀 Nvidia Up 30% After Earnings

🚀 Nvidia Up 30% After Earnings

Plus Canadian Banks Report (TD, BMO, RBC, and more!)

🚀 Nvidia Soaring on Strong Guidance

Nvidia, the leading player in the semiconductor industry, is up over 30% since releasing its Q1 report, beating analyst expectations in both revenue and earnings. Nvidia posted revenues of $7.19 billion, up 19% from the previous quarter.

Even more exciting was Nvidia’s forward guidance for Q2, with a forecast of $11 billion, over 50% higher than the current quarter and far above analysts’ expectations.

💰 The $1 Billion Market Cap Club

This positive outlook boosted Nvidia's shares by almost 25% during the trading day, propelling its market cap past $940 billion, up from $755 billion.

To put this in context, Nvidia’s market cap grew ~$200 billion an hour after earnings, a number larger than each of its competitors' entire market caps:

AMD ($AMD): ~$175 billion market cap

Intel ($INTC): ~$120 billion market cap

Micron ($MU): ~$75 billion market cap

This puts Nvidia on track to hit a $1 trillion market cap, a title currently held by only four other U.S. companies: Apple, Microsoft, Alphabet, and Amazon.

💡 $NVDA stock is now up over 172% in 2023.

Shares are at a record high, surpassing their previous peak from November 2021 during the chip shortage.

Despite the optimistic forecast, Nvidia reported a 13% year-on-year decline in revenue, attributed to slowed growth in their gaming and professional visualization segments.

While the majority of the market remains bullish, with most analysts giving Nvidia a buy rating, there are skeptics that point with caution to Cisco’s stock during the internet boom, which saw its revenue and stock price explode before falling 90% when the internet bubble popped.

🏦 Canadian Banks Report Earnings

All the major Canadian banks reported earnings this week except National Bank which reports on May 31st.

A common theme among the reports was higher-than-expected provisions for credit losses, which significantly impacted earnings. While most of the banks beat revenue estimates, only one, CIBC, beat earnings and all except CIBC are down this week as much as 5%.

📉 Royal Bank of Canada

(-3.99% this week)

RBC posted higher-than-anticipated provisions for credit losses and an overall underperformance in its wealth management and personal & commercial banking divisions.

Despite the earnings miss, RBC Capital Markets delivered strong results with an 11% rise in corporate and investment banking revenue.

Revenue: $13.52 billion vs. $13.16 billion expected 👍

Earnings Per Share (EPS): $2.65 vs. $2.81 expected 👎

📉 Bank of Montreal

(-4.14% this week)

BMO beat revenue expectations but reported a big miss on earnings, with net income at $1.05 billion, compared to $4.75 billion in the same quarter the previous year.

The decrease is primarily attributed to provisions for credit losses, which soared to $1.02 billion from only $50 million in the prior year as the company inherited loans from the recently acquired Bank of the West.

Revenue: $8.44 billion vs. $8.22 billion expected 👍

Earnings Per Share (EPS): $2.93 vs. $3.23 expected 👎

📉 Toronto-Dominion Bank

(-5.14% this week)

TD beat revenue but missed earnings, reporting a net income of $3.4 billion, down 12% compared to the same quarter last year. The decline in net income was mainly attributed to challenging market conditions and higher provisions for credit losses.

Despite these challenges, TD beat on revenue, pointing to several business segments that showed strong revenue and earnings growth despite market conditions including its Canadian Personal and Commercial banking, and U.S. Retail Banking, and Wealth Management and Insurance.

Revenue: $12.54 billion vs. $12.38 billion expected 👍

Earnings Per Share (EPS): $1.94 vs. $2.08 expected 👎

📉 Scotiabank

(-0.54% this week)

Scotiabank reported the only miss on both revenue and earnings as provisions for credit losses and higher expenses impacted their quarterly performance.

Provisions for credit losses increased to $709 million from $219 million a year ago, and non-interest expenses rose slightly to $4.57 billion.

Revenue: $7.93 billion vs. $8.01 billion expected 👎

Earnings Per Share (EPS): $1.70 vs. $1.77 expected 👎

📈 Canadian Imperial Bank of Commerce

(+1.21% this week)

Despite a challenging quarter for banks across the board, CIBC managed to be the only bank to beat analyst expectations on both revenue and earnings.

Notably, CIBC’s Canadian Personal and Business Banking division showed strong growth, up 28% from last year. To indicate its confidence, the bank announced a 2.4% increase in its quarterly dividend from $0.85 to $0.87 per share.

Revenue: $5.70 billion vs. $5.69 expected 👍

Earnings Per Share (EPS): $1.70 vs. $1.63 expected 👍

🛍 The Luxury Industry Loses $30B

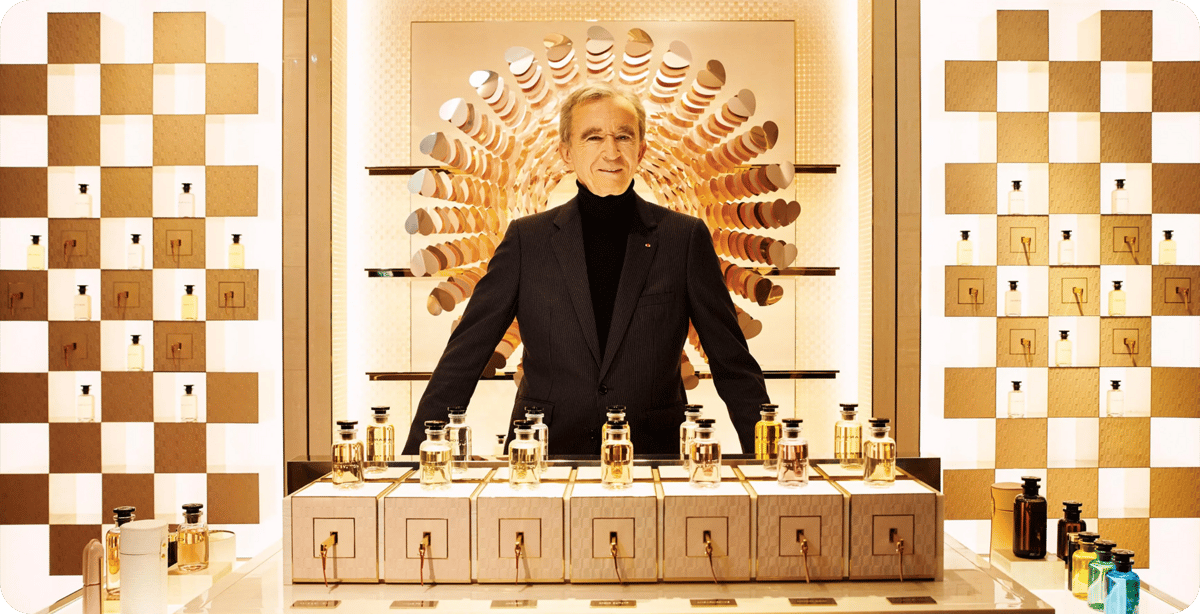

Luxury goods stocks suffered a huge setback earlier this week, losing more than $30 billion in market value in a single day. The slump was driven by growing concerns over a potential slowdown in US spending, with Deutsche Bank signaling this as a "building concern" for the sector.

The stocks most impacted include Hermes International ($RMS), LVMH Moët Hennessy Louis Vuitton ($LVMHF), and Gucci owner Kering ($KER), which saw declines of ~5% this week.

The sector saw a little bounce back on Friday climbing back 1-2% over the days trading.

Bernard Arnault, the world's wealthiest person and founder of luxury conglomerate LVMH, saw his net worth take a hit of $11.2 billion in a single day.

Even with LVMH shares falling by over 5%, LVMH’s most significant drop in over a year, Arnault's family net worth remains over $223 billion, largely attributed to the stock's strong performance this year.

📈 Even accounting for the recent downturn, LVMH's shares have maintained an upward trajectory and are up over 20% this year.

🎙 Top Discussions This Week

👇 Click on the post to open in the Blossom app (only works on your phone)

🗞️ What else you might’ve missed:

Adobe released an AI-powered tool for Photoshop.

Tesla will likely open a new factory by the end of the year.

Palo Alto Networks saw a ~8% jump after beating earnings expectations.

Intuit fell ~8% after missing revenue expectations and lowering its earnings outlook.

Canadian wildfires are raising threats of another oil-sands shutdown.

Apple announced it signed a multi-billion dollar deal with Broadcom.

Alibaba’s cloud division to lay off ~7% of its workforce.