- The Weekly Buzz 🐝 by Blossom

- Posts

- 🚘 Tesla Dips After Earnings Drop 37%

🚘 Tesla Dips After Earnings Drop 37%

Plus, Beyond Meat soars 600%, Netflix tanks 10%, and Google jumps 4% on $10B AI deal with Anthropic...

MARKET RECAP

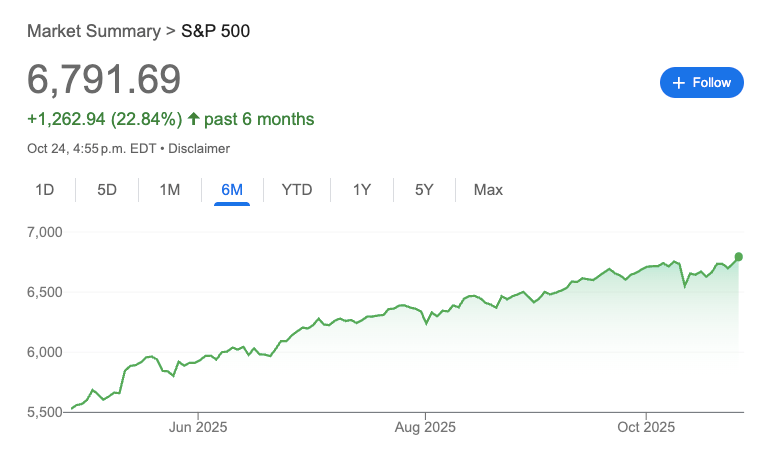

🤝 Market Hits Record High After US and China Agree to Framework of a Trade Deal

😰 2 weeks ago, the S&P posted its biggest decline since May after Trump’s tweets about reigniting the trade war with China.

⭐️ Well since then, the market has more than bounced back, with the US and China agreeing to the framework of a trade deal ahead of Trump and President Xi Jinping’s meeting this Thursday, sending markets up for a second week in a row:

The S&P 500 rose +1.9%

The Nasdaq-100 rose 2.2%

The Canadian TSX index rose 0.8%

💸 While US-China trade (and tariffs in general) seem to be the main factor swinging the markets, we also saw a boost this week from inflation coming in lower than expected, making analysts very confident in another 0.25% rate cut from the Fed this week.

💰 We also saw strong corporate earnings with companies like Coca-Cola, General Motors, Intel, Ford, and American Airlines, all beating expectations this week, with Microsoft, Google, Apple, and Amazon all reporting this upcoming week on Wednesday, Thursday, and Friday.

😰 But while most companies beat earnings this week, Blossom’s 5th most held stock Tesla ($TSLA) had a bit of a shaky week after profits fell from last year and missed analyst estimates.

📊 So before we cover some of the other big stories this week (like Google’s deal with Anthropic and the rise of the newest meme stock Beyond Meat), let’s break down Tesla’s earnings report and see whether this is a one-off miss or a sign of trouble ahead…

🚘 Tesla Dips After Earnings Drop 37%

First, let’s look at the numbers:

✅ Revenue: $28.1B, 6.7% higher than analysts expected, and 11.6% higher than last year

❌ Net Income: $1.4B, 37% lower than last year

❌ Earnings per Share: $0.50, 7% lower than expected

Looking at Tesla’s specific business lines:

🚘 Automotive Revenues were $21.2B, a +6% increase from last year

🧰 Services Revenues were $3.5B, a +22% increase from last year

⚡️ Energy Storage Revenues were $3.4B, a +44% increase from last year

🤑 Sales Are Growing Again

🟢 The biggest green flag from the report was a return to sales growth.

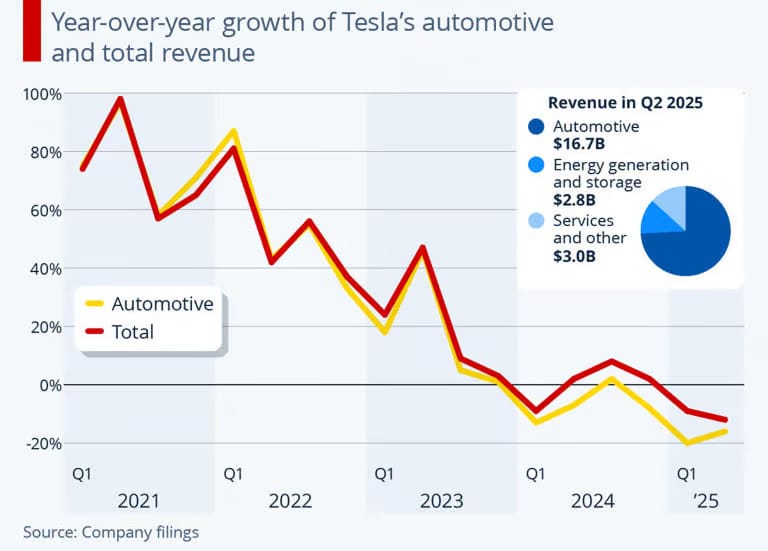

😰 Last earnings, Tesla had its second quarter in a row with a drop in auto revenue, continuing a long pattern of declining growth rates, with this scary chart getting thrown around a lot:

🤩 So the 12% revenue growth this quarter was a welcome turnaround for investors.

🤔 Now that said, some have called out that some of this sales boost was likely just sales that were pulled forward into this quarter as consumers rushed to take advantage of federal EV credits, which ended at the end of this quarter.

😰 Profits Fall As Operating Costs Soar

🤔 But with revenue growth turning around, why did the stock dip?

📉 Well, despite strong revenues, Net Income plummeted 37% with Tesla’s operating costs increasing 50%.

🤖 It’s a bit hard to tell what the cause of this is, as neither Elon nor Tesla’s CFO spent much time talking about car sales or profits on the earnings call, but Elon says that it was in part due to AI and ‘other R&D projects’.

🙏 Because of this, it looks like Tesla investors mostly forgave it for the poor quarter, as the majority of Tesla’s valuation is riding on these future projects anyway (as we’ll discuss below).

📈 Little Impact on the Stock

In fact, despite the big earnings drop, Tesla’s stock only dipped 3% this week, which is barely even visible if you zoom out on the stock chart:

🚀 While the stock fell 3% since Monday, it’s still up +65% over the past year, meaning investors are largely unfazed by the struggles with Tesla’s automotive business.

🎯 That’s because for Tesla investors, all hopes are riding on the promise of self-driving cars, robotaxis, and humanoid robots, and across those, Elon made some big promises, saying

🔋 ‘Volume production’ of the Cybercab, heavy-duty electric Semi trucks and new, battery energy storage system, called Megapack 3, is expected in 2026 with Cybercab production starting in Q2.

🤖 Tesla has started building first-generation production lines for the company’s humanoid Optimus robots, with Musk saying Tesla expects to show its Optimus V3 in the first quarter.

🚗 Musk said he expects Tesla to remove the human safety drivers from its Austin Robotaxi vehicles this year, and said the company should be operating the service in eight to 10 metro areas by the end of 2025.

🪄 The Musk Magic Premium

📊 As we’ve covered before, a lot of the success of these products is already heavily baked into Tesla's valuation, with a Price-to-earnings ratio of nearly 200x… over 8x the PE ratio of the S&P 500, and nearly 7x higher than Nvidia.

😮 One writer at Fortune calls this the ‘Musk Magic’ Premium, and points out that if Tesla were valued at a 30x price-earnings ratio like the S&P 500, it would be worth ~$100B, 90% less than the current $1.4T valuation. The writer says this ~$1.3T difference is essentially the value the market is ascribing to Musk’s future vision.

💡 While an oversimplification, I think it’s a helpful reminder for Tesla shareholders that Tesla doesn’t operate like a normal stock. While I like to cover the company’s earnings, car sales, revenues, etc., the reality is that Tesla’s valuation isn’t really based on any of that - it’s based on whether you beleive Elon’s bold visions can come true.

🤞So for the 15,000 shareholders of Tesla in the Blossom community, my fingers are crossed for you all, and I look forward to keeping you updated on Tesla and whether Musk still has his magic touch…

💡 Ok, before we shift gears to the other big headlines this week (from Beyond Meat soars 600%, Netflix tanking 10%, and Google jumping 4% on $10B AI deal with Anthropic), a quick word from this week’s sponsor Fidelity Investments Canada!

PRESENTED BY FIDELITY INVESTMENTS CANADA

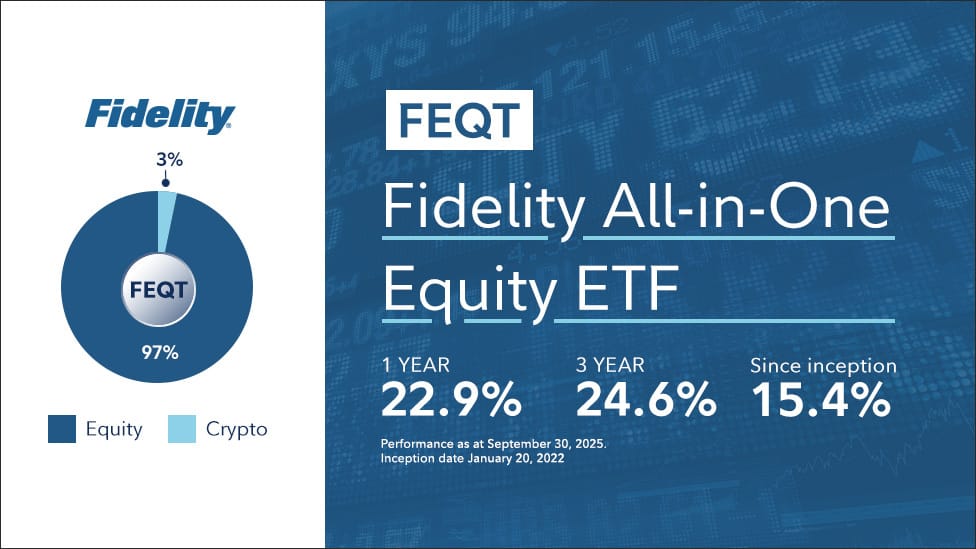

⭐️ Confidently Diversify with Fidelity All-in-One Equity ETF

📊 Looking to diversify your equity exposure without the hassle of doing it on your own? There’s a Fidelity All-in-One ETF for that!

⭐️ FEQT is a single-ticket solution designed with a strategic equity mix and a small allocation to crypto. Global, U.S., Canadian, small cap, large cap—they’re covered.

🛠️ And thanks to the rebalancing feature, Fidelity All-in-One ETFs take care of the day-to-day maintenance, so you don’t have to.

🍔 It’s like ordering a combo meal, but for your portfolio, everything you need to get diversified and feel confident that you’ve got broad market exposure.

*See Fidelity Disclaimer at the end of the newsletter

IN OTHER NEWS

🗞️ Top Headlines This Week

🍔 Beyond Meat Jumps 600%, Becoming the Latest Meme Stock

After announcing a major US retail partnership with Walmart to bring its burgers and chicken pieces to 2,000 stores, Beyond Meat ($BYND) surged +600% in 3 trading days amid a heavy short squeeze

Before the jump, Beyond Meat’s short interest (aka people betting against the stock) was 80% of its float, making the stock one of the most shorted stocks on the market.

Despite the massive jump, since the recent peak, the stock has fallen 40% and is still down -99% from all-time highs reached in 2021, with analysts warning about declining demand for plant-based meat.

📈 Google Jumps 4% After Announcing $10B Partnership with Anthropic

Google ($GOOG) and AI-startup Anthropic announced a deal for tens of billions of dollars, giving Anthropic access to up to 1 million of Google’s Tensor Processing Units (TPUs) and over 1 GW of compute capacity by 2026.

Despite the deal, Amazon remains Anthropic’s biggest partner, with analysts estimating that Anthropic will account for 5% of Amazon’s AWS cloud growth in its recent quarter.

But the new deal increases Google’s pivotal role in Claude’s ‘diversified architecture’ approach, and analysts expect will also continue to boost Google’s cloud revenues (like it has for Amazon) as the partnership deepens

😰 Netflix Falls 10% After Poor Earnings

This week Netflix ($NFLX) reported earnings, and while revenue grew 17%, Net income came in at $2.55 billion, or $5.87 per share, 15% below the company’s targets of $6.87 and analyst estimates of about $6.94.

Netflix blamed a tax dispute in Brazil for the earnings letdown, which led to a surprise $619M tax

Despite strong ad-sales momentum and record US smart-TV viewership, investors were spooked by the expense and a “lack of revenue upside” in Q4 guidance, sending the shares down more than 10%.

While the core business is still growing, Netflix’s forward PE of ~37x puts them well above the S&P 500 average of ~24x, meaning investors demand exceptional numbers to justify the premium.

Fidelity Investments Canada Disclaimer

Source: Fidelity Investments Canada ULC, as at September 30, 2025; ticker symbol FEQT.

Returns shown in Canadian dollars, net of fees.

Commissions, trailing commissions, management fees, brokerage fees and expenses may be associated with investments in mutual funds and ETFs. Please read the mutual fund or ETF’s prospectus, which contains detailed investment information, before investing. The indicated rates of return are historical annual compounded total returns for the period indicated, including changes in unit value and reinvestment of distributions. The indicated rates of return do not take into account sales, redemption, distribution or option charges or income taxes payable by any unitholder that would have reduced returns. Mutual funds and ETFs are not guaranteed. Their values change frequently, and investors may experience a gain or a loss. Past performance may not be repeated.

Each of the Fidelity All-in-One ETFs (excluding Fidelity All-in-One Fixed Income ETF) has a neutral mix which includes a small allocation to Fidelity Advantage Bitcoin ETF™ ranging between 0.5% and 3%. Additionally, if the portfolio deviates from its neutral mix by greater than 5% between annual rebalances, the portfolio will also be rebalanced. In the case of a Fidelity All-in-One ETF’s allocation to cryptocurrency, if the portfolio weight exceeds twice its neutral weight, the allocation will be brought back to its neutral weight, with any proceeds being reallocated to the other underlying Fidelity ETFs at their approximate strategic allocations. Such rebalancing activity may not occur immediately upon crossing that threshold but will occur shortly thereafter.

The ETF/ETF Funds are subadvised by Geode Capital Management, LLC.

© 2025 Fidelity Investments Canada ULC. All rights reserved. Fidelity Investments is a registered trademark of Fidelity Investments Canada ULC.