- The Weekly Buzz 🐝 by Blossom

- Posts

- 😰 Tesla Sinks 9% After Auto Sales Drop (Again) - US

😰 Tesla Sinks 9% After Auto Sales Drop (Again) - US

Plus, Google jumps 4% after strong earnings, Intel plummets 12%, and more...

TOP STORY

😰 Tesla Sinks 9% After Auto Sales Drop (Again)

📈 As Big Tech earnings season comes into full swing, the market had a strong week overall, with all the major indexes showing healthy gains:

The S&P 500 rose +1.3% (now up +8.9% year-to-date)

The Nasdaq-100 rose +0.6% (now up +11% year-to-date)

The TSX rose +0.5% (now up +10.4% year-to-date)

😰 However, despite an overall strong week, there were some major losers:

Intel ($INTC) crashed -11.6%

Lockheed Martin ($LMT) fell -8.4%

And Tesla ($TSLA) initially fell -9% after earnings but recovered slightly on Thursday/Friday, ending the week down -5.5%

🚘 So, since Tesla is the 9th Most Held Stock on Blossom, let’s break down the earnings and talk about what’s going on for Blossom’s favourite EV company, before checking on Google and some of the other major headlines this week!

📊 Breaking Down Tesla’s Earnings

There’s no way to sugarcoat it, Tesla’s earnings were rough, and even Elon admitted that the company faces “a few rough quarters ahead.”

🔍 Looking at the high-level numbers

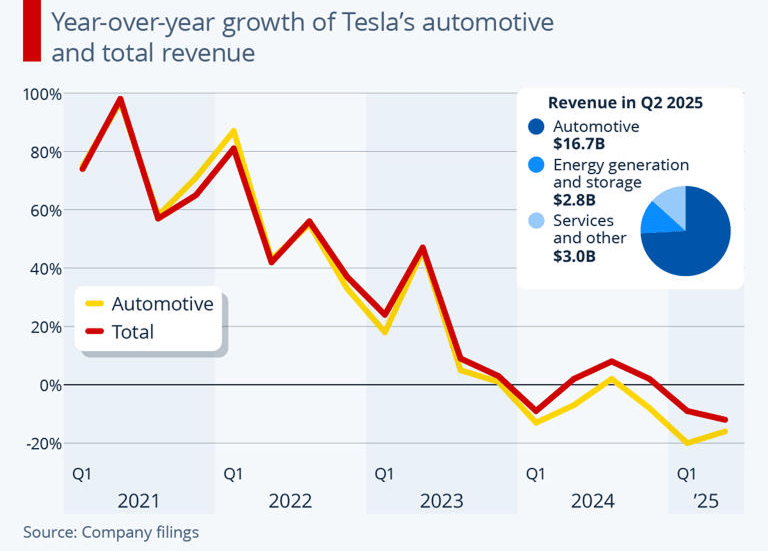

❌ Revenue was $22.5B, down -12% from a year ago

❌ Operating Income was $923M, 25% less than expected

Looking at Tesla’s specific business lines:

🚘 Automotive Revenues were $16.6B, a -16% drop from last year

🧰 Services Revenues were $3B, a +17% increase from last year

⚡️ Energy Storage, which has long been a bright spot in Tesla earnings, fell -7% from last year to $2.8B

📉 This marks the second quarter in a row with a drop in auto revenue, and if we zoom out further, continues a long pattern of declining growth rates in Tesla’s revenues:

🤑 Despite this, Tesla still sits at a forward price-earnings ratio of 168x, which is 7x higher than the overall S&P 500 and over 4x higher than even Nvidia.

👀 Generally, a company commands a high price-earnings ratio due to high growth rates (like Nvidia), so for Tesla to be reporting falling revenues with such a high PE is quite notable.

🪧 Many blame Elon’s political antics, first pro-Trump and then anti-Trump, for hurting auto sales and turning a Tesla purchase into a political statement (which we covered in detail back in June here).

🙏 Many have been hopeful that a new lower-priced model will help boost Tesla’s sales but on the earnings call Musk seemed to indicate that the new model was just a Model Y with fewer features and less power and range as opposed to a completely new design.

😢 Loss of Regulatory Credits

💰 One of the reasons for Elon’s war with Trump was Trump’s ‘Big Beautiful Bill,’ which removes the $7,500 tax credit for US EV buyers starting in October and evaporates Tesla’s regulatory credit sales.

😬 With auto sales already on the decline, Tesla will face an increasingly difficult challenge turning things around with the loss of these credits.

📉 In this quarter alone, Tesla’s revenue from regulatory credits fell from $890M to $439M, and Tesla says it will continue to fall next quarter.

🤖 Can Tesla Be Saved By Robots and Robotaxis?

❌ The thing is, to Musk (and probably most Tesla investors), the auto sales don’t really matter.

✨ In fact, Musk barely mentioned car sales at all during the hour-long earnings call, focusing instead on Robotaxis and the Optimus robot, with Musk saying these products will make Tesla “the most valuable company in the world by far.”

😎 But before we turn our attention to robotaxis and Optimus + analyst reactions to Tesla earnings, a quick word from today’s sponsor, YieldMax ETFs!

PRESENTED BY YIELDMAX ETFS

💸 ULTY: Diversified Option Income from YieldMax’s Covered Call Strategy

👀 Looking to maximize income potential in today's fast-moving markets?

⭐️ Introducing ULTY, the YieldMax Ultra Option Income Strategy ETF.

💰 ULTY is a diversified, actively managed ETF designed to seek income by collecting option premium from a wide mix of reference assets across the YieldMax lineup. Instead of relying on a single stock, ULTY implements a multi-asset covered call strategy across 15 to 30 high-volatility securities. The fund regularly adjusts its positions seeking to optimize income and adapt to market conditions.

📊 ULTY provides indirect exposure to the share price returns of the underlying securities, with a cap on upside participation. This structure aims to offer consistent income while spreading risk across multiple names. Whether you want high yield distributions or a multi-ticker solution for accessing a dynamic options income engine, ULTY is built to deliver.

****Investing in ULTY involves a high degree of risk. ULTY does not invest directly in any underlying securities.***Click here to view fund prospectus. ***Distributed by Foreside Fund Services, LLC.***

TOP STORY CONT.

🤖 Can Tesla Be Saved By Robots and Robotaxis?

⭐️ For years, investors have been giving Elon the benefit of the doubt, justifying Tesla’s valuation by pointing to Elon’s ambitious vision to transition Tesla from an automaker into an AI robotics company. So what’s the latest on the robots and robotaxis?

🚘 Robotaxis Expand to San Fran

🤠 In late June, Tesla introduced a limited Robotaxi service in Austin, Texas, and although there were some hiccups, investors largely celebrated the launch.

🏖️ On Thursday, Business Insider reported that Tesla plans to expand its Robotaxi service to San Francisco this weekend, causing Tesla stock to rise +4% between Thursday morning and the end of the week.

❌ What’s interesting is Tesla can’t legally do this yet, as it doesn’t have the permits for ‘Drivered Pilot AV’. So even though Tesla is calling it a ‘robotaxi service,’ it will still need to have human drivers, not just monitoring, but actually driving.

🇺🇸 Despite the limited rollout so far, Musk claimed in the earnings call that the robotaxi service would be available to half the US population by the end of the year and that its purpose-built robotaxi is scheduled for large-scale production in 2026.

🤖 Robots

⭐️ The other big growth area for Tesla is the Optimus humanoid robots. On the earnings call, Musk says the company plans to eventually produce more than a million robots each year, with the goal of producing at least 5,000 this year. But according to some sources, the number produced is only in the hundreds.

Still, Musk remains ever-optimistic, saying:

“We will scale Optimus production as fast as possible and try to get to a million units a year as quickly as possible. We think we can get there in less than five years. That’s a reasonable aspiration.”

🎯 Analyst Reactions

The overall theme among analysts is summed up nicely by Analyst Gordon Johnson:

“The stock price no longer rests on selling cars. It hinges almost entirely on the promise of a robot-driven, self-driving future”

While for years, investors have given Musk the benefit of the doubt on his big promises, in the words of long-tim Tesla bull Dan Ives “Wall street is losing some patience.”

According to Garrett Nelson, an Analyst at CFRA Research:

Investors have been very forgiving of Tesla for several quarters now, despite obvious headwinds to their business. But I think its investors are taking a more realistic view of the story at this point. Some of [Elon’s] brilliance has been his ability to keep investors focused on the long term and ignoring the near term and intermediate term. Now, headwinds are difficult to ignore.

💡 My Thoughts

🎯 Tesla’s valuation is almost entirely based on a future business model (in AI robotics), which right now is fairly unproven.

🔭 If Tesla were valued at the PE ratio of its biggest rival, BYD (53x), it would be worth only 30% what it is now, meaning ~70% of Tesla’s valuation is based on a hypothetical future.

🙏 To me, that makes the stock too speculative. And while I plan to stay away, Elon has defied expectations before, so for the sake of the over 11,000 of you holding Tesla, I hope that Elon can defy expectations yet again.

As always, this is just my opinion, and I’m excited to read your thoughts! See all the posts related to Tesla from the TSLA stock page on Blossom 😊

🌼 On Blossom, Tesla was the #16th Most Bought and the #6 Most Sold stock this week!

BIG TECH EARNINGS

📈 Alphabet Jumps 4% After Beating Revenue and Earnings

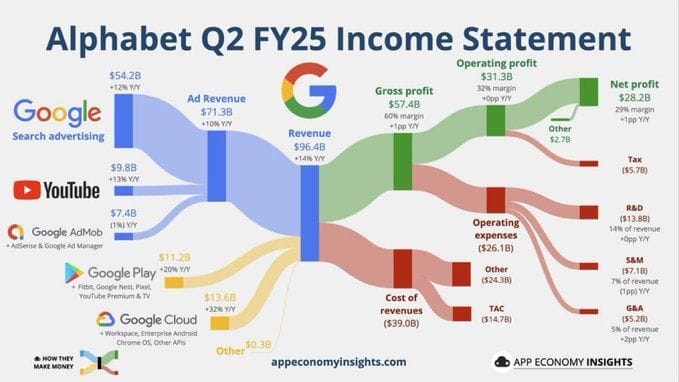

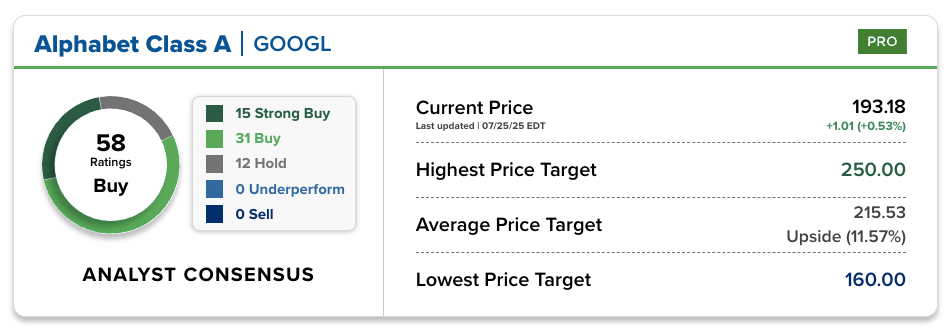

✅ In contrast to Tesla, Alphabet’s Q2 beat expectations across all major categories:

💰 Revenue: $96.4B, up +14% from last year and +2.6% higher than expected

🔍 Google Search Ad Revenue: $54.2B, up 12% from last year

📺 YouTube Ad Revenue: $9.8B, up 13% from last year

☁️ Google Cloud Revenue: $13.6B, up 32% from last year

💸 Earnings per Share also grew to $2.31, beating expectations by 6%.

🤖 More AI Spending

💰 In February, Alphabet said it expected to spend $75B in capex to boost its AI strategy, and this quarter, they increased that number to $85B due to “strong and growing demand for Cloud.”

✅ With the overall markets (and Nvidia in particular) being heavily fueled by continued AI spending, this increase is good news for Big Tech.

🤝 Google has had a few big wins lately in AI. Just last week, OpenAI annouced plans to use Google’s cloud infrastructure for ChatGPT.

🔍 Search Revenue Still Growing

😮💨 One of the biggest worries for GOOGL investors is the threat of AI competition to its search revenue, which still makes up 56% of Alphabet’s business. So seeing a 12% growth in Google Search Ad revenue is very good news.

🚀 According to Google’s CEO, AI Overviews - Google’s AI search product that summarizes search results - has grown rapidly from 1.5B monthly users last quarter to over 2B this quarter.

⬆️ Analysts Raise Targets

⭐️ Analysts were overall very positive about Alphabet’s earnings, with many raising price targets. Here are a few notable comments:

“We continue to be of the view (contrary to some negative investor sentiment currently) that Alphabet can successfully navigate the current multi-year evolution of its core Search product by leveraging its current strengths.”

“Engagement with Alphabet’s AI Overview (AIO) has been particularly strong, especially among younger users, driving incremental queries and demonstrating solid monetization, even at this early stage of adoption. AIOs have already reached over 2bn MAUs globally, and are contributing to over 10% of incremental query growth where available, which suggests there is significant room for upside as adoption increases.”

Google delivered what we believe is a defining quarter w/32% Google Cloud revenue growth, increasing scale of AI search products, and greater benefits from AI across every part of the business,” Anmuth said in a Thursday note. “We believe the combination of strong AI-driven Cloud demand and accelerating backlog makes Google Cloud a bigger driver of the bull case going forward.”

🌼 On Blossom, the community was mixed on the stock, with Google ($GOOG) ranking as both the #22 Most Sold and the #23 Most Bought!

ALSO IN THE NEWS

🗞️ Other Key Headlines this Week

🗞️ Apart from Tesla and Google, here are some of the other top headlines this week!

💻 Intel ($INTC) sinks -12% as CEO Lip Bu Tan signals cost cuts over innovation. Despite beating revenue forecasts, investors worry Intel is prioritizing frugality over regaining chip leadership.

🌯 Chipotle ($CMG) falls -13% as profit dips despite revenue growth. Same-store sales dropped 4% and margins compressed, but new restaurant openings and drive-through expansion remain on track.

🏥 UnitedHealth ($UNH) fell another -1%, now down -9% over the past month, as DOJ probe into Medicare billing intensifies. The company says it’s cooperating and conducting internal reviews, but questions remain over its risk coding practices.

🇯🇵 Toyota ($TM) and Honda ($HMC) rally over 8% after Japan–US trade pact confirmed. The deal lowers auto tariffs and secures a $550B investment from Japan. US automakers say the deal gives an unfair edge to Japanese imports.

🍩 Krispy Kreme ($DNUT) jumps +41% and GoPro ($GPRO) soars +64% as retail traders hunt new meme targets.

🐝 The Weekly Buzz is researched and written by Blossom’s CEO @maxstocks. If you have any feedback on the Buzz, feel free to reply to this email! Thanks for reading to the end! 😎