- The Weekly Buzz 🐝 by Blossom

- Posts

- 📉 Tesla Stock Falls Despite Long-Awaited Robotaxi Rollout

📉 Tesla Stock Falls Despite Long-Awaited Robotaxi Rollout

Plus, the S&P returns to all-time-highs, Nike soars 20% after earnings, and more...

MARKET RECAP

⭐️ The S&P Hits All-Time Highs As Tariff Fears Ease

☀️ It was a great week in the markets with the indexes flying high!

The S&P 500 is up +3.4%

The Nasdaq-100 is up +4.2%

Bitcoin is up +0.9%

🚀 With this week’s rally, the S&P 500 is now back to all-time highs, rising over +23% since the tariff crash in April.

🙏 The theme this week was increasing optimism across 3 main factors:

🏦 Interest Rates: Investors are increasingly optimistic that the Fed will cut interest rates, pricing in a 93% chance that the Fed will lower rates by the end of September, up from 70% just a week ago.

❌ Tariffs: Tariff worries have eased significantly as Trump relaxes some of his harsher tariffs.

🇮🇷🕊️🇮🇱 Middle East: Fears of conflict in the Middle East have settled slightly after Trump’s announcement of a ceasefire between Israel and Iran.

“In the investment public's mind, it went from a sense of tremendous pessimism to what seems to be optimism that this will all fall into place.”

😰 But despite the market flying high this week, one popular stock fell flat: Tesla ($TSLA), falling -1.2% and now down -10% over the past month.

🚗 While that might not seem too significant, this was the week Tesla unveiled its long-awaited Robotaxi in Texas so many expected it to be a big week for the stock.

🔮 As Elon has said many times, ‘the future of Tesla is fundamentally based on large-scale autonomous cars’ and some analysts believe robotaxis account for 60% of Tesla’s $1T valuation, so the success of Tesla’s robotaxi is absolutely critical for the company.

🔍 So let’s take a look at what’s going on, why the stock is falling, how investors are reacting, and what all this means for Tesla moving forward…

✈️ P.S. Blossom is going on tour! Grab your tickets to the Blossom Investor Tour in Toronto, Vancouver, Montreal, and Calgary where we’ll be hosting events with food, drinks, panel discussions, and more!

TOP STORY

📉 Tesla Stock Falls Despite Long-Awaited Robo-Taxi Rollout

🚗 After years of hype, expectations, and promises, the robotaxi finally hit the roads last Sunday, with Tesla launching a limited version of the robotaxis in Austin, Texas.

👏 Like an Uber (or a Waymo), customers hail the taxi with an app and pay a flat rate of $4.20. Many of the early customers (who were mostly pro-Tesla social media influencers) took to X to applaud the rollout.

That's a wrap! In the last 36 hours, I've taken a total of 20 @Tesla Robotaxi rides and traveled 92 miles. No interventions, no critical safety issues. All my rides were smooth and comfortable.

Thank you, Tesla, for letting me be a part of this experience—and congrats to the

— Sawyer Merritt (@SawyerMerritt)

4:17 AM • Jun 24, 2025

🏆 On Monday (the day after the launch) Tesla stock rose +10% as Musk celebrated the roll-out as a triumph.

😰 But over the week, cracks began to show as videos of the self-driving cars breaking traffic laws and other mishaps raised concerns, driving the stock down from Tuesday to Friday.

But before we dive into the issues, and what investors and analysts have to say about the rollout, a quick word from today’s sponsor Purpose Investments!

PRESENTED BY PURPOSE INVESTMENTS

📢 XRP: Now in an ETF – With No Management Fee Until 2026

💸 XRP isn’t out to reinvent money. It's here to move it - faster and cheaper across borders.

🌐 If a tool that streamlines cross-border payments seems promising to you, you can now invest in XRP through a regulated, easy-access ETF.

🔒 Introducing the Purpose XRP ETF (TSX: XRPP)

The Purpose XRP ETF was built for access – with security and simplicity in mind.

No management fee until Feb. 1, 2026

Direct spot XRP exposure (not futures or synthetic products)

CAD-hedged units – protect against currency swings with Canada’s only XRP ETF offering this

TFSA/RRSP eligible – you can invest with registered accounts.

Brought to you by a firm that knows crypto – we launched the world’s first spot Bitcoin ETF and are Canada’s largest digital asset ETF manager by AUM *

🧠 Looking to Learn More?

What Is XRP? Your beginner’s guide to XRP and what makes it so special.

What Is a Spot XRP ETF? Your guide to understanding a streamlined way to invest in XRP.

What Is Currency Hedging? Your intro to how currency hedging works, and why it matters when investing globally.

*See Purpose Footnotes and Disclaimer at the end of the newsletter

TOP STORY CONT.

😰 Videos of Robotaxis Entering Wrong Lanes, Driving Over Curbs, and More Raise Concerns

⛵️ The Robotaxi roll-out hasn’t been all smooth sailing. Videos of the taxi’s driving into oncoming lanes, speeding, slamming on brakes, and more have been documented in a viral Reddit thread and countless major news outlets have been covering the midhaps.

Some analysts say this is to be expected for an early rollout, but others say that it highlights that Tesla still has a long way to go before widespread adoption.

If Tesla was the first mover, even these mishaps could likely be shrugged off as the growing pains of the revolutionary technology, but unfortunately for Tesla - that’s not the case…

🚘 Waymo is Years Ahead

Waymo, which has been offering driverless rides since March 2022, is years ahead of Tesla - already servicing more than 250,000 paid trips a week in San Fransisco, LA, Pheonix, and Austin with plans to roll out soon in DC, Miami, and Atlanta.

🤔 So why is Tesla so far behind?

Well, unlike Tesla, which relies on AI and cameras, Waymo uses LIDAR, which uses laser pulses to create a 3D map around the vehicle. Elon has been adamant that ‘Lidar is lame’, saying it’s expensive and unnecessary.

Elon is right that LIDAR is expensive, costing $12,000 per vehicle compared to only $400 for cameras, but whether it’s ‘unnecessary’ is a huge source of debate. Some say that Elon’s decision to ditch LIDAR will ‘prove to be a big mistake’ but Elon and Tesla are adamant that not relying on LIDAR will prove to be a competitive advantage:

“Tesla self-driving can be deployed anywhere it’s approved. It does not require expensive, specialized equipment or extensive mapping of service areas. It just works.”

👀 Investor Reactions

Overall, Investors had a pretty mixed reaction to the rollout. Some, like long-time Tesla optimist Dan Ives called the launch ‘revolutionary’ and ‘the start of a golden era of autonomous’ but others called out a more fundamental worry:

The Robotaxi opportunity is already priced into shares.

The challenge many investors are pointing to is that, with Tesla stock worth over $1T (more than the next 20 automakers combined), the success of the Robotaxi may already be priced into the stock.

While some, like ARK Invest’s Cathie Wood, project that the robotaxi business could generate $951B in revenue for Tesla by 2029 (nearly 10x Tesla’s total revenue), many disagree, questioning whether the robotaxi business (especially with competitors like Waymo) is as large as Tesla and its supporters project.

Even long-time Tesla investors question the projections, with some citing this valuation disconnect as the reason for selling the stock:

I don’t see the upside at this point, but I see plenty of downside. I don’t expect the robotaxi to do much to boost the company’s value.

💡 My Thoughts

🧐 As for me, I tend to agree with the skeptics. Uber is only a $200B company (worth 1/5th of Tesla), so I don’t see how dominating the ride-sharing space with Robotaxis would drive the revenue Tesla (or Cathie Wood) is projecting.

📉 Also, with Tesla’s declining/stagnating auto business, much of the success from robotaxis already seems to be priced into the stock, so Tesla needs to not only deliver but overdeliver on the already high expectations.

🌼 I realize this may not be the most popular opinion, with Tesla ranking as the #9th Most Held stock on Blossom with over 14,000 holders (if we include the 2,700 of you who hold Purpose’s Tesla Yield Share ETF) - so please let me know what I’m missing by leaving a comment on my Blossom post here!

😎 In any case, this is just the beginning of the Tesla Robotaxi journey, so I look forward to keeping you updated as the story develops!

PRESENTED BY DYNAMIC FUNDS

🌎 Get Global Equity Exposure With DXGE, Which Has Delivered 17.95%

In today’s complicated investment landscape, finding income and growth can be a challenge. Introducing Dynamic Active Global Equity Income ETF (DXGE), an ETF that’s delivered for investors an annualized return of 17.95% since inception.*

⭐️ Why Dynamic Active Global Equity Income ETF (DXGE)?

Diversified Global Exposure: DXGE invests in a broad array of high-quality companies from around the world. Whether it’s technology in Silicon Valley, energy in the U.K., or consumer staples in Europe, our portfolio seeks to capture the best of what the global market has to offer.

Legitimately Active Management: Unlike traditional passive ETFs, DXGE employs Dynamic’s legitimately active management, which allows DXGE to respond to changing market conditions, capturing opportunities while minimizing risk.

Focused on Income: DXGE is specifically designed for income-seeking investors. We prioritize companies with a strong track record of dividend payments and sustainable cash flow.

✊ Seize the Global Opportunity with DXGE Global investing is back, as investors look to Europe and Asia, where many stocks are attractively valued. Get the global diversification your portfolio needs with DXGE, another proven performer from Dynamic Funds’ roster of active ETFs.

*See Dynamic Funds Disclaimer at the end of the newsletter

ALSO IN THE NEWS

🗞️ Other Key Headlines this Week

😎 Normally, I go into a bit more detail for each story here, but since the Tesla story was so long, I’m going to keep this section more brief with links to the full story if you’re interested!

👟 Nike ($NKE) soared +20% this week after Q4 earnings show that turnaround plan is working, posting smaller-than-expected drops in revenue and profit (see full story).

🤖 Nvidia ($NVDA) jumped +11% this week to record highs after Nvidia’s held it’s annual shareholder meeting on Wednesday where CEO Huang called robotics (currently 1% of Nvidia’s revenue) Nvidia’s ‘biggest opportunity’ (read full story).

🪙 Circle fell -24% this week, and Coinbase jumped +17% in line with my predictions last week that the valuation disconnect was unsustainable (see full story).

🚀 Rocket Lab ($RKLB) jumps 22% after securing two launch contracts wth the European Space Agency, and NATO boosts its spending target (see full story).

IN PARTNERSHIP WITH CBOE CANADA

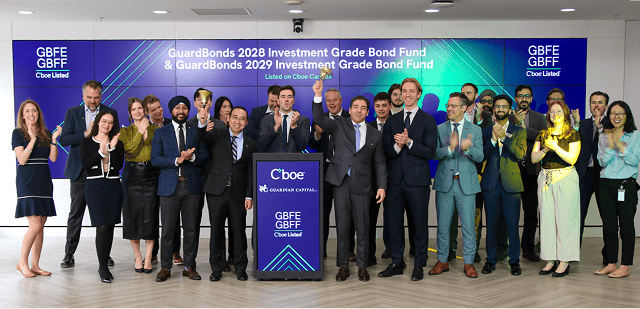

🚨 New Listing Alert! Guardian Launches 2 New GuardBond Funds

📣 Speaking of rocket lauches - another kind of launch happened this week with Guardian Capital launching two new GuardBond Funds onto the CBOE exchange!

🪜 According to Guardian, GuardBondsTM is a suite of actively managed, defined maturity bond funds that allows you to construct customized bond ladders.

🗓️ A bond ladder entails purchasing bonds that mature at different dates, usually based on calendar years. An investor may choose to weight a portfolio across several consecutive years equally, like rungs on a ladder. With each passing year, the investor is essentially taking a step up the ladder – the shortest maturity bond(s) will mature (the lowest rung on the ladder), cash proceeds will be received, and the investor will then climb up another rung by buying bonds maturing further out (adding a new rung to the top of the ladder).

On top of the 2025, 2026, and 2027 Funds, Guardian has now launched Funds for 2028 and 2029:

Purpose Investments Disclosure:

By digital asset ETFs under management as of April 24, 2025.

***Commissions, trailing commissions, management fees and expenses may all be associated with investment fund investments. Please read the prospectus and other disclosure documents before investing. Copies of the Prospectus may be obtained from purposeinvest.com. There can be no assurance that the full amount of your investment in a fund will be returned to you. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated. Crypto assets can be extremely volatile, and there is no guarantee that the amount invested will be returned to you.***

Dynamic Funds Disclosure:

*Inception date October 2023. Annualized return as of May 30, 2025.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated. The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

Dynamic Funds® is a registered trademarks of The Bank of Nova Scotia, used under license by, and is a division of, 1832 Asset Management L.P.

© Copyright 2025 The Bank of Nova Scotia. All rights reserved.